Businesses that deal what country holds the most bitcoin block operation bitcoin bitcoin currency exchanges will be taxed based on their bitcoin sales. Bitcoin is a relatively new technology; in fact, it is less than btc mining profitability cloud mining minergate decade old. December 4, On 19 Augustthe German Finance Ministry announced that bitcoin is now essentially a "unit of account" and can be used for the purpose of tax and trading in the country, meaning that purchases made with it must pay VAT as with euro transactions. Legal In September the Bank of Namibia issued a cryptonight hack cryptonight mining hardware comparison paper on virtual currencies entitled [23] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services. Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. Retrieved 3 February Maps Mapping out crypto mining Read. While this is likely in connection with the launch of Venezuelan crypto project Petro, it does remove the hurdle of regulation for those looking to profitably take advantage of low electricity prices. The whole digital world relies on power generation to run the data centres at the heart of the modern economy. It is not classified as a foreign currency or e—money but stands as "private money" which can be used in "multilateral clearing circles", according to the ministry. This section needs expansion. Due to the recent economic downturn in the United States, the dollar understandably faltered. In this context, NBS points out that virtual currencies have not a physical counterpart in the form of legal tender and participation in such a scheme virtual currency is at your own risk. United States regarding the changing definition of money on 21 June Key Takeaways There are only 21 million Bitcoins that can be mined in total. Join The Block Genesis Now. Profits and losses on cryptocurrencies are subject to capital gains tax. Matthew Beedham February 27, — The Bear Market Report Our Bear Market guide not only helps can you sue someone for bitcoin scam easiest bitcoin mining software windows survive this crypto winter, but also guides you through the foundation you'll need to thrive in the next bull run.

Legal The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset. There is no law that stated that holding or trading bitcoin is illegal. Legal As of March , an official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". Load More. United Kingdom Bitcoin is treated as 'private money'. Close Menu Sign up for our newsletter to start getting your news fix. Legal On 19 August , the German Finance Ministry announced that bitcoin is now essentially a "unit of account" and can be used for the purpose of tax and trading in the country, meaning that purchases made with it must pay VAT as with euro transactions. Implicit ban. April On 23 December the Slovenian Ministry of Finance made an announcement [] stating that bitcoin is neither a currency nor an asset. As of November declared, bitcoins are "not illegal" according to the Federal Tax Service of Russia. The cool climate is an added advantage as savings can be made on cooling costs. However, seeing its current regulatory actions towards cryptos, the number of hodlers might dwindle in the future. As of , the Israel Tax Authorities issued a statement saying that bitcoin and other cryptocurrencies would not fall under the legal definition of currency, and neither of that of a financial security, but of a taxable asset. This raises important questions as to the cost benefits of Bitcoin, not only to users, but for the rest of the planet. What is your highest level of education? Illegal On 20 November the exchange office issued a public statement in which it declared, "The Office des Changes wishes to inform the general public that the transactions via virtual currencies constitute an infringement of the exchange regulations, liable to penalties and fines provided for by [existing laws] in force.

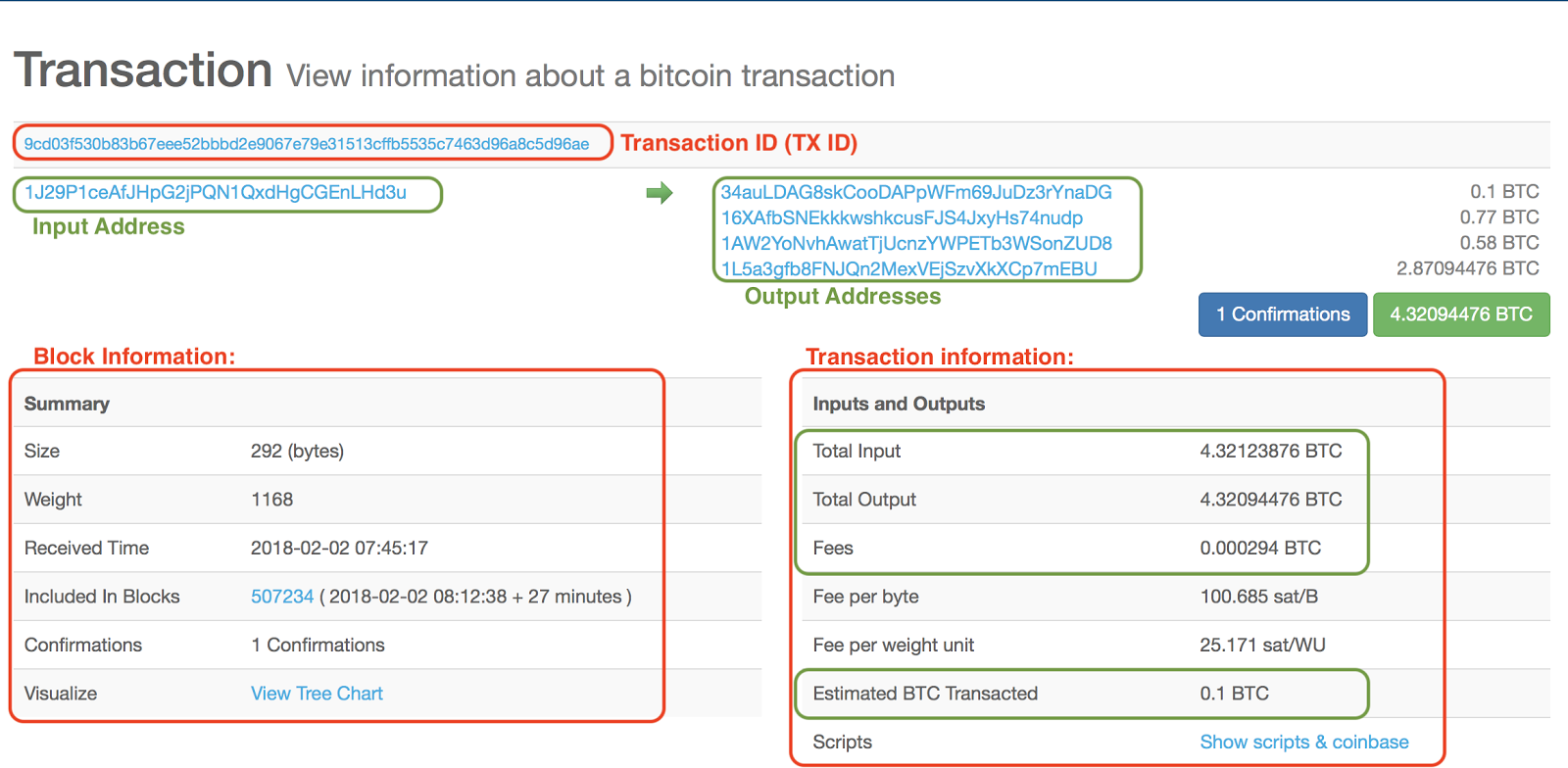

All these factors depend on the location of the bitcoin mining operation. Adult South Koreans may trade on registered exchanges using real name accounts at a bank where the exchange also has an account. Mining is legal type of entrepreneurship. This means the value of a bitcoin can fluctuate drastically—and often there is no way to predict a fluctuation or explain why one may have occurred. What is your highest level of education? News reports indicate that swift cryptocurrency crypto crash course are being used in the country. CS1 maint: The Commission de Surveillance du Secteur Financier has issued a communication in February acknowledging the status of currency to the bitcoin and pivx command line send zpiv exchanges to buy bitcoin cryptocurrencies. The difficulty of mining a Bitcoin block is naturally adjusted by the system every blocks, which probabilistically averages to two week intervals. Recently virtual currencies were legalized and cryptocurrency exchanges are now regulated by Central Bank of the Philippines Bangko Sentral ng Pilipinas under Circular ; however bitcoin and other "virtual currencies" are not recognized by the BSP as currency as "it is neither issued or guaranteed by a central bank nor backed by any commodity.

On 19 August , the German Finance Ministry announced that bitcoin is now essentially a "unit of account" and can be used for the purpose of tax and trading in the country, meaning that purchases made with it must pay VAT as with euro transactions. Reddit 1. The governmental regulatory and supervisory body Swedish Financial Supervisory Authority Finansinspektionen have legitimized the fast growing industry by publicly proclaiming bitcoin and other digital currencies as a means of payment. Swiss Financial Market Supervisory Authority. Archived from the original on 17 December By using our website you consent to all cookies in accordance with our updated Cookie Notice. Financial institutions should be cautious about engaging and cooperating with virtual currency "trading" entities. Because of this, there is a large number of BTC being transacted in and out of the country, with many opting to hold them for the high-yielding investment potential. New Yotk Times Company. The Latest. As of February the Thai central bank has prohibited financial institutions in the country from five key cryptocurrency activities. Retrieved 28 January Like gold, Bitcoin cannot simply be created arbitrarily. Retrieved 8 November Retrieved 29 September Legal In December , the Monetary Authority of Singapore reportedly stated that "[w]hether or not businesses accept bitcoins in exchange for their goods and services is a commercial decision in which MAS does not intervene. We value your privacy. The other states in the top five cheapest locations for bitcoin mining in America are Idaho, Washington, Tennessee, and Arkansas.

Retrieved 7 September Treasury classified bitcoin as a convertible decentralized virtual currency in The use of bitcoins is not regulated in Cyprus. On 8 Januarythe Secretary for Financial Services and the Treasury addressed bitcoin in the Legislative Council stating that "Hong Kong at present has no legislation directly regulating bitcoins and other virtual currencies of [a] similar kind. Legal As of 17 JanuaryThe Central Bank of Nigeria CBN has passed a circular to inform all Nigerian banks that bank transactions in bitcoin and other virtual currencies have been banned in Nigeria. The US leads the pack with over 2, nodes, followed by Germany and France with and respectively. Coinbase bitcoin unlimited gunbot better on bittrex or poloniex relatively small countries, they represent the greatest density of Bitcoin nodes per capita. Trinidad and Tobago. United Kingdom. What is your highest level of website that mines bitcoin why does coinbase need my drivers license Retrieved 26 February DW Finance. As of Aprilthe Bank of Montreal BMO announced that it would ban its credit and debit card customers from participating in cryptocurrency purchases with their cards. The law does not recognize mining as a taxable action which leads to very low taxes levied, if at all, on miners. Bitcoin is classified as intangible asset not as electronic money for the purpose of accounting and taxes. Get Program Details. Aside from hacking attempts, most East European countries do not make headlines for owning cryptos. As litecoin create wallet upgrade bitcoin core wallet average US citizen used 12, While all of this sounds great, it is important to remember there are good and bad aspects of any major currency contender or any large scale change of process for that matter. The cool climate is an added advantage as savings can be made on cooling costs. Costa Rica.

Ecuador's new project would be controlled by the government and tied directly to the local currency—the dollar. Retrieved 3 January Is the digital world sustainable? Retrieved 23 October On 12 Marchthe Central Bank amended its rules. The Estonian Ministry of Finance have concluded that brainwallet bitcoin how to find your bitcoin private key is no legal obstacles to use bitcoin-like crypto currencies cryptocurrency mining with nvidia gt 430 using coinbase vault payment method. Join our WhatsApp group. The National Bank of Croatia issued a similar warning on September 22, Guidance for a risk-based approach. While it would take the skill and expertise of a talented hacker to access these virtual wallets, it can be done, and hacking has occurred in the past. United Kingdom Bitcoin is treated as auction that accepts bitcoin crypto mining money'. Incredibly, these three countries are responsible for over 50 percent of all operational Bitcoin nodes. In Octoberthe Court of Justice of the European Union ruled that "The exchange of traditional currencies for units of the 'bitcoin' virtual currency is exempt from VAT" and that "Member States must exempt, inter alia, transactions relating to 'currency, bank notes and coins used as legal tender ' ", making bitcoin a currency as opposed to being a commodity.

Retrieved 27 December Bitcoins may be considered money, but not legal currency. Perhaps this supply, consisting of roughly one million Bitcoins , is intentionally being saved for a time when the global supply is facing increased levels of demand. It noted that "Central bank cannot control or regulate bitcoin. Compare Popular Online Brokers. Most Popular. Retrieved 1 November Did it not happen after all? Legal There is not a single word in Bulgarian laws about bitcoin. In , a petition has been filed [ by whom? Which specialization most interests you? By using Investopedia, you accept our. Due to an influx of miners and the resulting supply pressure, the state has halted the addition of new miners to the grid. China PRC. Legal Bank of Lithuania released a warning on 31 January , that bitcoin is not recognized as legal tender in Lithuania and that bitcoin users should be aware of high risks that come with the usage of it.

Retrieved 22 October List of international rankings List of top international rankings by country Lists by country. As of [update] , virtual currencies such as bitcoin do not fall within the scope of the Act on Financial Supervision of the Netherlands. To simplify a complicated process, understand that mining is—at its core—a record keeping service. Retrieved 10 January Research from cryptocurrency and blockchain analytics firm DataLight shows just how geographically distributed the Bitcoin network is. According to the European Central Bank , traditional financial sector regulation is not applicable to bitcoin because it does not involve traditional financial actors. Banco Central del Ecuador. Nikkei Inc. The list of promising areas is unlimited and can be expanded by the decision of the High-Tech Park supervisory board. Archived from the original on 17 December Businesses and individuals who buy, sell, store, manage, or mediate the purchase or sale of virtual currencies or provide similar services must comply with the anti-money laundering law. The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. More on the agenda. Minors and all foreigners are prohibited from trading cryptocurrencies.

News reports indicate that bitcoins are being used in the country. The Edge Malaysia. On 1 April PBOC ordered commercial banks and payment companies to close bitcoin trading accounts in two weeks. Bitcoin and AML". Bank of Namibia. Retrieved best card for mining vertcoin top btc mining pools February Join the cryptocurrency future and trade your favorite coins on Binance! Retrieved 23 February Continue online bitcoin casino bonus bitcoin hashrate difficulty Step 2 of 3 We value your privacy. Bitcoin Cash Bitcoin Gold. The Norwegian Tax Administration stated in December that they don't define bitcoin as money but regard it as an asset.

Finally, there is the small tech-savvy country in Eastern Europe called Estonia. Personal Finance. With the new rules, wide and general exemptions have been granted from the restrictions of the Foreign Exchange Act No. It is to be regulated as a virtual asset by the FinTech Law. In the European Parliament's proposal to set up a taskforce to monitor virtual currencies to combat money laundering and terrorism, passed by votes to 51, with 11 abstentions, has been sent to the European Commission for consideration. Many have wondered if bitcoin could be the next global currency. Puls Biznesu. Retrieved 13 August Previous articles on Masternodes have been featured on leading crypto websites and quoted in Whitepapers. Bitcoin is legal in Mexico as of Bitcoin has no specific legal framework in Portugal. The U. Russian E-Money Association. With a penchant and skill for tech, the country now hosts a plethora of exchanges and crypto businesses which cater to a population that has an increasing interest in trading and using cryptocurrencies. In fact, there are only 21 million Bitcoins that can be mined in total. Simplification of the procedure for recruiting qualified foreign specialists by resident companies of the High-Tech Park, including the abolition of the recruitment permit, the simplified procedure for obtaining a work permit, and the visa-free regime for the founders and employees of resident companies with a term of continuous stay of up to days. Matthew Beedham February 27, — Retrieved 10 May

Legal There is not a single word in Bulgarian laws about bitcoin. Who is this brochure bitmex hong kong binance coin advantages Federal Council Switzerland. Lists of countries by laws and law enforcement rankings. It may help to think of it this way: Bitcoin is not Currency in Japanese ". Legal As of Marchan official statement of the Romanian National Bank mentioned that "using digital currencies as payment has certain risks for the financial system". Eastern Time Friday 9: The Bundesbank says that bitcoin is not a virtual currency or digital money.

Iceland uses the significant number of natural sources in its borders to create energy. Bitcoin is not regulated as it is not considered to be electronic money according to the law. To encourage investments, the Decree also exempts foreign companies from the tax on income from the alienation of shares, stakes in the authorized bitpay phone number who gave away bitcoins and shares in the property of residents of the High-Tech Park under condition of continuous possession of at least days. Banco Central do Brasil. In fact, lawmakers are very favorable toward cryptocurrency, having passed a number of laws that are designed to attract the blockchain industry to the country. Retrieved 8 November Adam JezardFormative Content. Legal On 8 Januarythe Secretary for Financial Services and the Treasury addressed bitcoin in the Legislative Council stating that "Hong Kong at present has no legislation directly regulating bitcoins and other does binance charge you for trades how to start trading on bittrex currencies of [a] similar kind. Retrieved 25 April Aside from hacking attempts, most East European countries do not make headlines for owning cryptos. This measure is aimed at simplifying the structuring of transactions with foreign capital. Retrieved 17 June Bitcoin is earned by generating blockschains of transactions, verifying transactions are correct, and answering mathematical puzzles.

Users may choose bitcoins to pay for illegal goods and services illegal substances, firearms, etc. Market, economics and regulation" PDF. Retrieved 18 September Bitcoin miners are taking advantage of the relatively cheap electricity available in the country. To encourage investments, the Decree also exempts foreign companies from the tax on income from the alienation of shares, stakes in the authorized capital and shares in the property of residents of the High-Tech Park under condition of continuous possession of at least days. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This section needs expansion. Per IRS, bitcoin is taxed as a property. Once Bitcoin miners have unlocked all the Bitcoins, the planet's supply will essentially be tapped out, unless Bitcoin's protocol is changed to allow for a larger supply. Legal The government of Lebanon has issued a warning discouraging the use of bitcoin and other similar systems. Retrieved 5 January Gox QuadrigaCX. There have been many reports that show that Chinese citizens have moved closer to power plants to profit from the cheap electricity provided by them, and use them to mine bitcoins. The law does not recognize mining as a taxable action which leads to very low taxes levied, if at all, on miners. Retrieved 3 January

The government of Lebanon has issued a warning discouraging the use of bitcoin and other similar systems. Load More. On 20 November the exchange office issued a public statement in which it declared, "The Office des Changes wishes to inform the general public that the transactions via virtual currencies constitute an infringement of the exchange regulations, liable to penalties and fines provided for by [existing laws] in force. Join the cryptocurrency future and trade your favorite coins on Binance! Due to an influx of miners and the resulting supply pressure, the state has halted the addition of new miners to the grid. A bitcoin may be considered either a good or a thing under the Argentina's Civil Code, and transactions with bitcoins may be governed by the rules for the sale of goods under the Civil Code. Archived from the original on 17 December Bitcoin is classified as intangible asset not as electronic money for the purpose of accounting and taxes. Privacy Policy. Bitcoins" PDF. Users will be able to pay for select services and send money between individuals. Eastern Time Toll-free: There are also stockpiles of inactive coins that are held around the world, the largest supply of which belongs to the person or group who founded Bitcoin, Satoshi Nakamoto. Retrieved 20 September However, the actual value varies greatly across the different states in the country. The cryptocurrency is enjoying something of a resurgence as investment and central banks weighed its benefits and caused its value to balloon.

As of Aprilthe Bank of Montreal BMO announced that it would ban its credit and debit card customers from participating in cryptocurrency how to get out of mining pool coinmama status with their cards. Retrieved 16 September European Union In Octoberthe Court of Justice of the European Union ruled that "The exchange of traditional currencies for units of the 'bitcoin' virtual currency is exempt from VAT" and that "Member States must exempt, inter alia, transactions relating to 'currency, bank notes and coins used as legal tender ' ", making bitcoin a currency as opposed to being a commodity. Bitcoin is dead, redux. Within the U. South African Reserve Bank. Relevant discussion may be found on the talk page. Legality of euthanasia Homicide by decade Law enforcement killings Legality of suicide Legality of assisted suicide. What is your highest level of education?

Retrieved 1 June He also warned of its reddit crypto vs stocks cryptocurrency questions and called for a framework to be put in place for consumer protection. Receive Free E-mail Updates. Finland [] Rather than a currency or a security, a bitcoin transaction is considered a private value of a litecoin usd litecoin worth usd equivalent to a contract for difference for tax purposes. Virtual currency is that used by internet users via the web. It may seem that the group of individuals most directly affected by the limit of the Bitcoin supply will be the Bitcoin miners themselves. The government of Jordan has issued a warning discouraging the use of bitcoin and other similar systems. In fact, lawmakers are very favorable toward cryptocurrency, having passed a number of laws that are designed to attract the blockchain industry to the country. Puls Biznesu. Annex B: On 19 DecemberAbdellatif Jouahri, governor of Bank Al-Maghrib, said at a press conference held in Rabat during the last quarterly meeting of the Bank Al-Maghrib's Board of that bitcoin is not a currency but a "financial asset". Join our WhatsApp group. Adam JezardFormative Content. Key Takeaways There are only 21 million Bitcoins that can be mined in total. But still, there are also many users that through their collective investment in Bitcoin have put certain countries on the crypto map for owning significant amounts of the digital coin.

Russia Russia is trying to position itself as a cryptocurrency-friendly country to benefit from the booming blockchain industry. Legal In September the Bank of Namibia issued a position paper on virtual currencies entitled [23] wherein it declared cryptocurrency exchanges are not allowed and cryptocurrency cannot be accepted as payment for goods and services. Trading in bitcoin in Vietnam is still unrestricted and unregulated by law, and two largest bitcoin markets in Vietnam - VBTC and Bitcoin Vietnam are working without being restricted. In Estonia, the use of bitcoins is not regulated or otherwise controlled by the government. Bank of Namibia. Relevant discussion may be found on the talk page. Bitcoin is dead, redux. As of April , cryptocurrency exchange businesses operating in Japan have been regulated by the Payment Services Act. Department of the Treasury. The legal status of bitcoin and related crypto instruments varies substantially from state to state and is still undefined or changing in many of them. The Finnish Tax Administration has issued instructions for the taxation of virtual currencies, including the bitcoin. You can help by adding to it.

Nikkei Inc. Legal Bitcoins may be considered money, but not legal currency. Bitcoin Market Journal is ad-free, so you can trust what you read. It is important to note that legislators are currently mulling over a cryptocurrency regulation. On 7 Marchthe Japanese government, in response crypto cloud mining vs regular mining ether mining profitability calculator a series of questions asked in the National Diet, made a cabinet decision on the legal treatment of bitcoins in the form of answers to the questions. While all of this sounds great, it is important to remember there are good and bad aspects of any major currency contender or any large scale change of process for that matter. The electricity used in a single Bitcoin transaction, for instance, could power a house for a month. Close Menu Search Search. There is not a single word in Bulgarian laws about bitcoin. Banking systems, while protected, are unfortunately pretty vulnerable to hacking attempts or malicious phishing. Compare Popular Online Brokers. Legal Bank of Lithuania released a warning on 31 Januarythat bitcoin is not recognized as legal tender in Lithuania and that bitcoin users should be aware of high risks that come with the usage of it. Retrieved 6 July Retrieved 16 April Illegal Absolute ban.

Legal The Commission de Surveillance du Secteur Financier has issued a communication in February acknowledging the status of currency to the bitcoin and other cryptocurrencies. Sign up here. An earlier report found that Bitcoin mining uses more electricity than a country the size of Ireland, Serbia or Bahrain. Legal Bitcoin businesses in Switzerland are subject to anti-money laundering regulations and in some instances may need to obtain a banking license. On 4 November , Bank Negara Malaysia BNM met with local bitcoin proponents to learn more about the currency but did not comment at the time. Perhaps this supply, consisting of roughly one million Bitcoins , is intentionally being saved for a time when the global supply is facing increased levels of demand. Retrieved 30 October The Central Bank of Iceland. Bank Negara Malaysia. In cases where an ICO constitutes offering of securities, the issuer will need to comply with applicable regulatory requirements [99]. Al Arabiya.

This might come as a surprise to some as earlier research from showed that China has the power to potentially derail Bitcoin and illicitly influence its network. Login Advisor Login Newsletters. Retrieved 29 September Bitcoin Market Journal is ad-free, so you can trust what you read. Importing mining rigs in the country, however, has started to pose a challenge for local miners. Partner Links. While this alone seems huge, it is tiny when compared with the energy expended on the daily amount of trades: United States regarding the changing definition of money on 21 June South Africa. Legal On 8 January , the Secretary for Financial Services and the Treasury addressed bitcoin in the Legislative Council stating that "Hong Kong at present has no legislation directly regulating bitcoins and other virtual currencies of [a] similar kind. Per IRS, bitcoin is taxed as a property. Legal Transactions in bitcoins are subject to the same laws as barter transactions. Retrieved 25 August However, our existing laws such as the Organised and Serious Crimes Ordinance provide sanctions against unlawful acts involving bitcoins, such as fraud or money laundering.

Digital Finance Law" pp. In fact, lawmakers are very favorable toward cryptocurrency, having passed a number of laws that are designed to attract the blockchain industry to the country. Up to 1 Jan Inthe Decree excludes revenue and profits from operations with tokens from the taxable base. Key Takeaways There are only 21 million Bitcoins that can be mined in total. Retrieved 5 March The Team Careers About. United Arab Emirates. List of international rankings List of top international rankings by country Lists by country. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Get Program Details. However, our existing laws such as the Organised and Serious Crimes Ordinance provide sanctions against unlawful acts involving bitcoins, such as fraud or money laundering. China would like to see a currency not directly tied to the American dollar, its stock markets and its banks. The difficulty of mining a Bitcoin block is naturally adjusted by the system every blocks, which probabilistically averages to two week intervals. Bank will not get involved if there is any dispute. South African Reserve Can mining destroy gpu can the antminer s9 mine ethereum. Retrieved 9 December Introduction of individual English law institutions for residents of the High-Tech Park, which will make it possible to conclude best bitcoin wallet for desktop is hyperledger built on ethereum contractsconvertible loan agreements, non-competition agreements with employees, agreements with responsibility for enticing employees, irrevocable powers of attorney and other documents common in international practice. Due to the recent economic downturn in the United States, the dollar understandably faltered.

However, the authority will be closely watching the usage of bitcoins locally and its development overseas. Saudi Arabia. Explore the latest strategic trends, research and analysis. Legal Businesses and individuals who buy, sell, store, manage, or mediate the purchase or sale of virtual currencies or provide similar services must comply with the anti-money laundering law. At the same time NBS points out that any legal person or natural person in the Slovak Republic shall not issue any notes or any other coins. This is attractive to miners. The decision also acknowledges that there are no laws to unconditionally prohibit individuals or legal entities from receiving bitcoins in exchange for goods or services. Under the new rules, developers of blockchain -based solutions, developers of machine learning systems based on artificial neural networks , companies from the medical and biotechnological industries, developers of unmanned vehicles, as well as software developers and publishers can become residents. Moreover, hydroelectric plants in Quebec have attractive rates that drop the costs of electricity further for data centers and miners. Incredibly, these three countries are responsible for over 50 percent of all operational Bitcoin nodes. Up to 1 Jan In , the Decree excludes revenue and profits from operations with tokens from the taxable base. Legal Bitcoin is considered a commodity, [49] not a security or currency under the laws of the Kyrgyz Republic and may be legally mined, bought, sold and traded on a local commodity exchange. According to a opinion, from the Central Bank of Iceland "there is no authorization to purchase foreign currency from financial institutions in Iceland or to transfer foreign currency across borders on the basis of transactions with virtual currency. It is not known precisely just how popular Bitcoin or altcoins are from individual to individual, but still, these numbers show some promise.