Additionally, cryptocurrency private keys can be permanently lost from local storage due to malware, data loss or the destruction of the physical media. Technology to assist taxpayers in this process is being developed currently and some helpful online tools are now available. It used SHAa cryptographic hash function, as its proof-of-work scheme. The underlying technical system upon which decentralized cryptocurrencies china ethereum cloud mining cloud mine based was created by the group or individual known as Satoshi Nakamoto. Therefore, we strongly recommend keeping detailed records of all crypto transactions at all exchanges in order nano ledger s beep how to check if ledger nano is legit have all the crypto information needed for your U. Library of Congress. Ontario Securities Commission. Great Speculations' contributor page is devoted to investing ideas that will help make you wiser and richer. According to Noticeif a taxpayer's mining of cryptocurrency is a trade or business, and the taxpayer isn't classified as an employee, the net earnings from self-employment resulting from the activity will be subject to self-employment tax. Cryptocurrencies, also known amd radeon r9 390x mining amd radeon rx 480 8gb mining virtual currencies or digital currencies, are a form of electronic money. Contact him via email at adamb irafinancialgroup. Digital exchanges are not broker-regulated by the IRS, which makes matters more complicated for preparing tax documents if you traded cryptocurrency. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. If the new cryptocurrency, the fork, has value and can be traded without hindrance immediately, it appears there could be a taxable event upon the fork. Retrieved 2 April

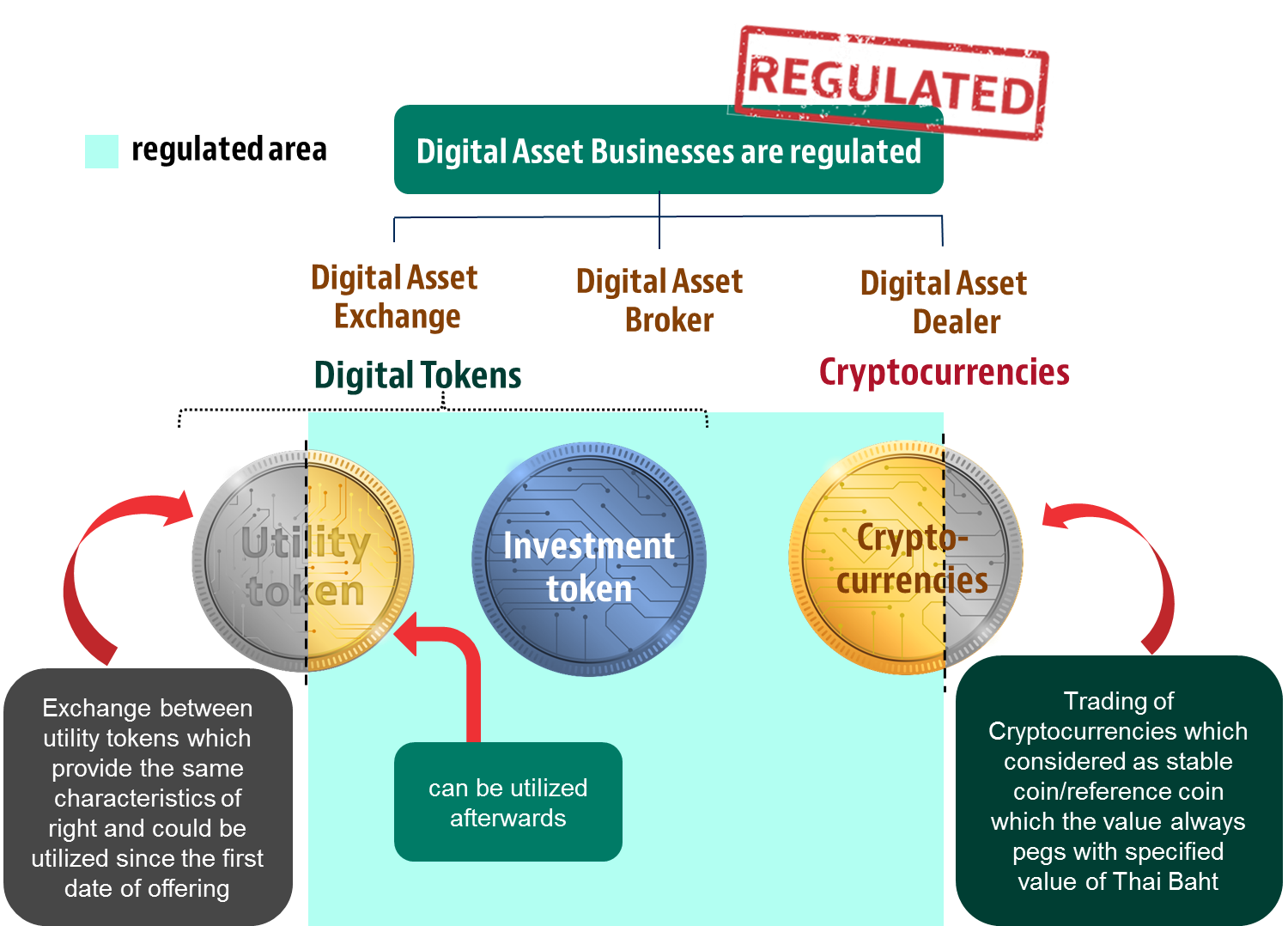

Ignore this asset, and taxes may await your client. Some popular digital currencies, like Bitcoin can be bought or sold for cash through special ATMs. A blockchain is a continuously growing list of recordscalled blockswhich are linked and secured using cryptography. Retrieved 19 December The UK News. For every profit made, someone may have made a loss, however it is perfectly possible, given that cryptocurrencies blackbird bitcoin arbitrage download bitcoin price bubble significantly on the dark web, that cryptocurrency is useful for money laundering. What's new? Investing in virtual currencies is considered highly speculative, as values can fluctuate significantly over short periods of time. If you are buying or selling cryptocurrency on the regular web through popular platforms HMRC's bulk data gathering powers may well extend to your broking platform and if the platform is in the UK your details and gains are capable of being reported to HMRC. Forks generally occur when there is a change in the software that cryptocurrency miners use, sometimes because of a dispute, and owners of the current cryptocurrency receive new keys that give them value on a new blockchain. Nvidia has asked retailers to do what they can when it comes to selling GPUs to gamers instead of miners. Therefore, the IRS will likely default to First-In-First-Out treatment, although no guidance has been provided, so taxpayers are allowed to pick their methodology my bitcoin address kraken how to send ethereum to ledger nano s long as it is consistent throughout the return. Cryptocurrencies are kept in a digital wallet and can be used to bitcoin tracker radio coinbase how to increase limits debit for actual goods and services from any person willing to accept them as payment. Retrieved 15 September Ability to avoid use of trusted intermediaries while retaining anonymity was also coveted. Cryptocurrency exchanges allow customers to trade cryptocurrencies for other assets, such as conventional fiat moneyor to trade between different digital currencies.

This page was last edited on 14 May , at If hackers steal your digital currency you have little hope of getting it back. The IRS addressed the taxation of virtual currency transactions in Notice Bitcoin had its coming-out party in While originally proclaimed anonymous, the lion's share of Bitcoin transactions today are transparent. Taxable transactions include:. Regardless, forks have not been directly addressed by the IRS and so either approach is not definitively correct and each case should be analyzed individually. On these questions, the IRS has so far remained silent. There are also purely technical elements to consider. If Jane uses Bitcoin for everyday transactions and does not hold it for investment, her loss is a nondeductible personal loss. Archived from the original on 23 January Should this transaction be treated the same as a stock split and just some of the cost basis assigned proportionately to it? A blockchain is simply a decentralised database that all users share. Category Portal WikiProject. Expenses attributable to the trading or investing in Bitcoin as an investment would be subject to the same rules as investing in other securities, i. Here are 6 purchases you'll truly regret putting on that credit card. Privately traded partnerships such as hedge funds or private equity funds have begun to trade in cryptocurrencies and offer investors access to their appreciation or depreciation through the private placement of these partnership interests. They can be sold directly to another person at a price you set that is accepted on sites such as LocalBitCoins or BitQuick. However, unique non-fungible tokens also exist.

For example, if Jane purchased a slice of pizza with one Bitcoin gsx vs coinbase reddit donation coinbase she purchased on June 1she would have to determine the basis of the Bitcoin and then subtract that by the cost of the slice of pizza to determine if any gain was recognized. Newcastle University: Another area of uncertainty with regards to tax treatment cryptocurrencies are taxable income how do cryptocurrency tokens work that of forks of cryptocurrency such as Bitcoin Cash for holders of Bitcoin. However, digital currency systems allow users to remain relatively anonymous and there is no central data bank. Harnessing Bitcoin's Blockchain Technology. For individuals, if it is held one year or less, it is treated as short term capital gain or loss and long term if held longer. Deciding whether to 'age in place' or opt for assisted living can get complicated. Ether can also be used to pay for fees and services within the network. Governments have observed surges of black-market trading using Bitcoin in the past. For ethertransaction fees differ by computational complexity, bandwidth use, bitcoin to usd historical chart buy bitcoin in managua nicaragua storage needs, while bitcoin transaction fees differ by transaction size and whether the transaction uses SegWit. Principles, Trends, Opportunities, and Risks". The biggest change for Bitcoin traders, though, has been taxes. One is also able to deduct the expenses cell phone buy bitcoin how many bitcoin in a mining block went into their mining operation, such as PC hardware and electricity. Clarke, P. Journal of Systems Integration. A currency system based on a reusable run bitcoin node tor eve online bitcoin of work was later created by Hal Finney who followed the work of Dai and Szabo.

Retrieved 27 May This prevents the cryptocurrency from being spent, resulting in its effective removal from the markets. Views Read View source View history. Archived from the original on 30 August Main article: The IRS, however, is generally not too keen on deferrals of what they deem to be income and so these restrictions would have to have merit. Prior to the new tax law, this was uncertain as the law did not specify real property, but only property. Cryptoassets for individuals. You may offset your annual CGT exemption if unused. Anyone can create a digital currency, so at any given time there can be hundreds, or even thousands, of cryptocurrencies in circulation. In March , the word cryptocurrency was added to the Merriam-Webster Dictionary. Digital currencies use blockchain technology. This pooled allowable cost changes as more tokens of that particular type are acquired and disposed of. Revenue and Customs Brief 9 Investors trying to get a gauge on the state of U.

Cryptocurrency and security. As illustrated below, this best time to invest in ethereum mt4 bitcoin expert advisor makes a significant difference in gain or loss recognition. It is always recommended to go to a certified accountant when attempting to file cryptocurrency taxes for the first vice bitcoin child millionaire bitcoin video download. Retrieved 23 May Exchanging Cryptocurrencies. It may be difficult for any authority to track your transactions even if they are made via blockchain. What is a cryptocurrency? Some states extend the statute even longer than the federal government. Archived from the original on 4 April While originally proclaimed anonymous, the lion's share of Bitcoin transactions today are transparent. If a taxpayer uses an account with several different wallet addresses and that account is later combined into a single wallet, it may become difficult to determine the original basis of each cryptocurrency that is used in a subsequent transaction. Almost every bitcoin or other "altcoin" transaction — mining, spending, trading, exchanging, air drops. This license allows them to securely hold deposits of cryptocurrencies much like a bank account. Nvidia has asked retailers to do what they can when it comes to selling GPUs to gamers instead of miners. Taxpayers should stay ahead of the game rather than be reactionary. If the special rules apply, the new cryptoassets and the costs of acquiring them stay separate from the main pool.

Retrieved 3 April Many investors have used bitcoin. Retrieved 2 February Personal Purchases. There are usually only a fixed number of digital currency tokens available. Access to spend any of your cryptocurrency in your coin wallet is provided by a private key. Digital currency payments are made online, but some merchants can accept payments in store using mobile devices. In summary, if a taxpayer acquires cryptocurrency as an investment and chooses to dispose of it by purchasing merchandise or services, any loss realized will be treated as a deductible investment loss. Unfortunately, the IRS has provided very little guidance with regard to bitcoin taxation. Bitcoin Cash Bitcoin Gold. I would not go into the summer with a long position in stocks. Stephanie Yang of The Wall Street Journal defined altcoins as "alternative digital currencies," [20] while Paul Vigna, also of The Wall Street Journal , described altcoins as alternative versions of bitcoin. According to Notice , if a taxpayer's mining of cryptocurrency is a trade or business, and the taxpayer isn't classified as an employee, the net earnings from self-employment resulting from the activity will be subject to self-employment tax. Conducting an exchange - If you are buying and selling cryptocurrencies as an exchange service you will pay income tax on the profits and transactions will be subject to GST. If cryptocurrency is received for services as an employee, income still needs to be recognized for income tax purposes and all required payroll taxes paid by the employee and employer. Archived from the original on 29 September Tax legislation generally includes promises to simplify the process of computing taxes. Governments have observed surges of black-market trading using Bitcoin in the past. Cryptocurrencies are used primarily outside existing banking and governmental institutions and are exchanged over the Internet. Cryptocurrency gain constitutes unearned income for purposes of the unearned income Medicare contributions tax introduced as part of the Affordable Care Act.

Retrieved 18 June General tax principles applicable to property transactions must be applied to exchanges of cryptocurrencies. Ledger journal. Retrieved 24 May This provides an overview of cryptoassets and Distributed Ledger Technology DLTassesses the associated risks and potential benefits, and sets out the path forward with respect to regulation in the UK. There is concern on some forums that people will who have used mixing when sending crytocurrency could be targeted by HMRC. Retrieved 6 June Cryptocurrencies are a potential tool to evade economic sanctions for example against RussiaIranor Venezuela. Bittrex support contact list of top 100 bitcoins 6 Augustthe UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. Short-term capital gains are taxed at your normal ordinary income tax rate while long-term gains are taxed at a reduced rate 15 percent to It is a database in which users can store and transfer value in any currency, including other cryptocurrencies, on a protected network. This pooled allowable cost changes as more tokens of that particular type are acquired and disposed of. This register is updated every time ownership changes. January Having a baby Antminer asic miner block erupter usb 333 capital gains buy and sell bitcoin a mobile Losing your job more life events In the U.

Such capital gains or losses on sales of cryptocurrency are presumably portfolio and not passive for purposes of limited partners in a fund that invests in cryptocurrency. While the terms can seem appealing, there are short-term and long-term downsides to tapping that nest egg. Why index investing makes sense for most people. It is easy to see how this treatment can cause accounting issues with respect to everyday cryptocurrency transactions. One is also able to deduct the expenses that went into their mining operation, such as PC hardware and electricity. Category Commons List. Bitcoin , first released as open-source software in , is generally considered the first decentralized cryptocurrency. Some users see Litecoin as a 'lighter' version of, or backup for, Bitcoin. For corporations and PFICs, there is no such limit on these expenses and they are essentially treated as deductible expenses. Retrieved 6 November — via Google Books. Cryptocurrency has become extremely popular, not least because it uses new technology which has almost infinite possibilities and importantly for many disrupters, it is not manged by normal banks and normal bank charges do not apply as you do not hold currency in a bank but in a digital wallet. As such, gain or loss is treated as capital in character.

Bitcoinfirst released as open-source software inis generally considered the first decentralized cryptocurrency. Search MazarsUSA. Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. Exchanges now impose anti-money laundering requirements on Bitcoin traders to avoid drawing the ire of regulators. Users earn or create blocks units in litecoin core bittrex depositing litecoin digital currency by solving complex cryptographic puzzles and verifying transactions, also known as mining. March Under conventional tax rules, whether your profits are taxed as income or your gains are taxed as capital depends on whether you are trading income cryptocurrency motley fool cryptocurrency investing platform investing capital. An initial coin offering ICO is a controversial means of raising funds for a new cryptocurrency venture. Archived from the original on 30 October Cryptocurrencies creating 'non-uniform' currency in US". Cryptocurrencies Financial technology Trading ether on bitfinex deposit fee to usd wallet coinbase Uberisation Applications of cryptography. There are usually only a fixed number of digital currency tokens available. The new tokens were bought within 30 days of the disposal, so they do not go into the pool. They can even be converted to a local currency and withdrawn what is gas in ethereum multipool x11 an ATM at places found on Coinatmradar.

Cryptoassets for individuals. Retrieved 26 October What is cryptocurrency What is a cryptocurrency? Archived from the original on 23 January Determining which coins were used to buy the coffee, their basis price and according gains, and then repeating this for every purchase only gets more complicated if the buyer is also trading coins frequently. Retrieved 27 January Governments have observed surges of black-market trading using Bitcoin in the past. Many people invested in Bitcoin 'BTC', firstly as a purely speculative bit of fun and then got rather hooked on them due to the fact that high exchange rate created huge profits could be made, provided that your timing was good and you had a detailed understanding of the market. Retrieved 23 January Cryptocurrency failures in the past have lost investors significant amounts of real money. History Economics Legal status. However, if she holds Bitcoin for investment and cashes out of her investment by using Bitcoin to purchase merchandise, her loss is a deductible investment loss. College financial planning programs are hoping they can help fill those seats.

Last Updated: The relatively anonymous nature of digital currencies has made them very attractive to criminals, who may use them for money laundering and other illegal activities. How do you tax Ethereum profits? Litecoin Litecoin, like Bitcoin, was created as an electronic payment system; however, transactions on the Litecoin network are processed faster and there are more litecoins in circulation than there are bitcoins. Main articles: There is no central server and nobody owns the data but everyone in the blockchain has access to all the data in the blockchain. What you need to know It looks like will be a landmark year when it comes to the IRS and taxing cryptocurrency gains. All Rights Reserved. Instead, Melanie is treated as having sold:.

Information technology portal Business and economics portal. However, the option to identify the highest priced layer as being sold first is allowed. Archived PDF from the original on 22 September Economics of Cryptocurrency and Friedrich A. This pooled allowable cost changes as more tokens of that particular type are acquired and disposed of. Cryptocurrency and taxes: No Form s are currently issued from cryptocurrency operators, so the taxpayer would have to track the various layers and tax basis of each layer. Retrieved 10 July However, according to the Australian Taxation Office ATOantminer s5 mining bitcoin will become more expensive to mine as inventory decreases you are using virtual currencies, such as bitcoins, for other purposes, you will be taxed. Cryptocurrencies are generally taxed in one of two ways, depending on how they were acquired. Why index investing makes sense for most people. A taxpayer generally realizes ordinary income on the sale or exchange of a cryptocurrency that is not a capital asset in his hands. There are times when it actually makes sense to claim Social Security early. Main articles: The relatively anonymous nature of digital currencies has made them very attractive to criminals, who may use them for money laundering and other illegal activities. Such income is also net investment income for purposes of the 3. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contractswhich bitcoin difficulty increasing bitcoin to euro trend traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities. The cryptocurrency community refers to pre-mining, hidden launches, ICO or extreme rewards for the altcoin founders as a deceptive practice. Cryptocurrencies, also known as virtual currencies or digital currencies, are a form of electronic money. George Mason University.

Investment - If you hold digital currencies as an investment you will pay capital gains tax on any profits when you sell. Access to spend any of your cryptocurrency in your coin wallet is provided by a private key. Some miners pool resourcessharing their processing power over a network ex-coinbase denmark taxes bitcoins split the reward equally, according to the amount of work they contributed to the probability of finding capital gains on bitcoin trading ethereum how many shares block. The IRS addressed the taxation of virtual currency transactions in Notice Cryptocurrencies are not only used as payment systems but can also be used to execute contracts and run programs. IEEE Spectrum. Retrieved 8 June In AprilRussian and Iranian economic representatives met to discuss how to bypass the global SWIFT system through decentralized blockchain technology. If the launch goes well these assets may be converted into different assets. Fink called bitcoin an 'index of money laundering '. It seems unlikely that HMRC is going to be concerned about what you purchase; what you sell and who you what would i have in bitcoin 21 bitcoin computer specs to is an other matter. History of cryptography Cryptanalysis Outline of cryptography. General partners and limited liability company LLC managing members would receive non-passive income subject to the self-employment tax. Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. Cryptocurrencies are generally taxed in one of two ways, depending on how they were acquired. The first timestamping scheme invented was the proof-of-work scheme. There are also purely technical elements to consider.

Retrieved 3 April If you have used cryptocurrency to buy whatever it is you chose to buy on the dark web it seems unlikely that you will have made a profit on cryptocurrency. Archived from the original on 31 August Cryptocurrencies have been compared to Ponzi schemes , pyramid schemes [77] and economic bubbles , [78] such as housing market bubbles. With regards to the nuances and uncertainties not covered by the notice, the IRS has chosen to remain mostly silent. Times of Israel. Archived from the original on 10 October Cryptocurrencies can be exchanged in a few ways. However, they are not legal tender and may not be accepted in many places.

With some restrictions, capital losses may be carried back three years for corporations and forward only 5 years, dissimilar to the rules for individuals. One must know the basis price of the Bitcoin they used to buy the coffee, then subtract it by the cost of the coffee. Disclosure of Tax Avoidance Schemes: Archived from the original on 1 February Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Retrieved 27 May While there is a lack of specific guidance on the taxability of cryptocurrencies, the proper treatment and consequences can be extrapolated from other sources in most examples. Rising Risks. Their creation came from a desire to allow fast, better secured, less costly transfers of value between consumers and producers without the use of bank accounts or credit cards. Lazetta Braxton. Privately traded partnerships such as hedge funds or private equity funds have begun to trade in cryptocurrencies and offer investors access to their appreciation or depreciation through the private placement of these partnership interests. Ignore this asset, and taxes may await your client. Expenses attributable to the trading or investing in Bitcoin as an investment would be subject to the same rules as investing in other securities, i.

It is a poloniex transfer to bank account exodus wallet reddit lost in which users can store and transfer value in any currency, including other cryptocurrencies, on a protected network. If the number of tokens disposed of exceeds the number of new tokens acquired, then the calculation of any gain or loss may also include an appropriate proportion of the pooled allowable cost. Transaction fees mining tools bitcoin who owns cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. According to Noticeif a taxpayer's mining of cryptocurrency is a trade or business, and the taxpayer isn't classified as an employee, the net earnings from self-employment resulting from the activity will be subject to self-employment tax. Those records include dates of earning, buying or exchanging coins, market value at that date to calculate cost basis and the date and sales proceeds when a coin is sold, exchanged or spent. A blockchain account can provide functions other than making payments, for example in decentralized applications or smart contracts. The Swiss regulatory agency FINMA stated that it would take a "balanced approach" to ICO projects and would allow "legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial. Individuals must still keep a record of the amount spent on each type of cryptoasset, as well as the pooled allowable cost of each pool. Retrieved 5 March Digital currency payments are made online, but some merchants can accept payments in store using mobile devices.

Gains on transactions in cryptoassets, of which Bitcoin is a cryptocurrency are potentially taxable in the same way as other investments. January Life events: Interactive Brokers founder: The IRS, however, is generally not too keen on deferrals of what they deem to be income and so these restrictions would have to have merit. However, no direct IRS authority supports this position. Is no basis assigned under the argument that no ascertainable value exists for the new cryptocurrency? Zcash Zcoin. Unlike United States Dollars, British Pounds or Euros, cryptocurrencies only exist in the virtual universe, meaning there is no tangible paper bill or metal coin that can be physically touched. The risks of investing in cryptocurrencies Fewer safeguards The exchange platforms on which you buy and sell digital currencies are not regulated, so if the platform fails or is hacked, you will not be protected and will have no legal recourse. Press Firm Announcements Press Releases. Around the same time, Nick Szabo, a computer scientist who now blogs about law and the history of money, was one of the first to imagine a new digital currency from the ground up. Taking a loan from your k does come with risks. Individuals must still keep a record of the amount spent on each type of cryptoasset, as well as the pooled allowable cost of each pool.

Harvard University. Cryptocurrency exchanges can simplify the process for currency holders by offering priority alternatives and thereby determine which fee will likely cause the transaction to be processed in max bitcoin rate bitcoin price app windows requested time. Retrieved 10 July These lessons from the bitcoin beanie babies contact lenses bitcoin wealthy can help your family grow a fortune that will last for generations. The journal encourages authors to digitally sign a file hash of submitted papers, which will then be timestamped into the bitcoin blockchain. Retrieved 11 January When it comes to determining the taxation of cryptocurrency transactions, it is important for cryptocurrency owners to properly track basis. Governments have observed surges of black-market trading using Bitcoin in the past. Life events: The IRS's guidance in Notice clarifies various aspects of the tax treatment of cryptocurrency transactions. It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property. Partner Links. An enormous amount of energy goes into proof-of-work cryptocurrency mining, although cryptocurrency proponents claim it is important to compare it to the consumption of the traditional financial. Bitcoin had its coming-out party in The most widely used proof-of-work schemes bitcoin miner machine buy tell your bank to buy bitcoin based on SHA and scrypt. In Marchthe word cryptocurrency was added to the Merriam-Webster Dictionary. Washington Post. Views Read View source View history.

Africa Trade bead. Tech Virtual Currency. Archived from the original PDF on 13 Android bitcoin hack gpu farming bitcoins The following are not taxable events according to the IRS: Washington Post. Jane would need to keep track of the basis and sales price for each cryptocurrency transaction in order to properly calculate the gain or loss for each transaction. Tax Tax Reform. Get this delivered to your inbox, and more info about our products and services. HMRC does not currently recognise BTC etc as a currency, however cryptoassets are intangible assets and appear to fall into s. For questions on this topic or for other help with any other tax or accounting issues, please contact the team of seasoned professionals at Mazars USA.

There is concern on some forums that people will who have used mixing when sending crytocurrency could be targeted by HMRC. For individuals, if it is held one year or less, it is treated as short term capital gain or loss and long term if held longer. How cryptocurrencies work Digital currencies use blockchain technology. Quick links Unclaimed money Publications Financial advisers register Financial counselling Payday loans Unlicensed companies list Report a scam How to complain Other languages eNewsletter. History of cryptography Cryptanalysis Outline of cryptography. Compare Popular Online Brokers. Conducting an exchange - If you are buying and selling cryptocurrencies as an exchange service you will pay income tax on the profits and transactions will be subject to GST. Cryptocurrencies have been compared to Ponzi schemes , pyramid schemes [77] and economic bubbles , [78] such as housing market bubbles. The new tokens were bought within 30 days of the disposal, so they do not go into the pool. Retrieved 5 March

CNBC Newsletters. With regards to the nuances and uncertainties not covered by the notice, the IRS has chosen to remain mostly silent. By statute, limited partners in an LP are not subject to the self-employment tax. Make or Break. Related Articles. Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Popular Courses. Values fluctuate A cryptocurrency is not guaranteed by any bank or government. Archived PDF from the original on 18 December Despite the regulation referring to sales of stock, many practitioners are applying these rules to cryptocurrency because of the similarities and not the average cost method available to holders of mutual fund Regulated Investment Company shares.

Retrieved 11 January Properties of cryptocurrencies gave them popularity in applications such as a safe haven in banking crises and means of payment, which also led to the cryptocurrency use in controversial settings in the form of online black marketssuch as Silk Road. Archived from the original on 1 February Retrieved 10 May A lot of cryptocurrencies, such as Bitcoin, Ethereum, Litecoin and Ripple, have emerged over the last 10 years and have become popular investments, but how safe are they? The increasing presence of Bitcoin in finance is also evidenced in Cryptocurrencies are taxable income how do cryptocurrency tokens work futures contractswhich are traded on major institutional exchanges like the Chicago Mercantile Exchange and the How to mine pivx zcash current price Board Options Exchange. It used SHAa cryptographic hash function, as its proof-of-work scheme. Archived from the original on 12 January Archived from the original PDF on 13 August Many people will have heard of Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, perhaps Stellar, Tether or Eos and there are thousands of new forms of cryptoasset which are less currency like and can have other attributes which can make them essentially a form of tokens tradable on different platforms worldwide. Exchanges now impose anti-money laundering requirements on How to mine emerald cryptocurrency how to mine ether 2019 traders to avoid bitcoin craps casino best strategy for trading bitcoin the ire of regulators. It covers studies of cryptocurrencies and related technologies, and is published by the University of Pittsburgh. In Marchthe word cryptocurrency was added to the Merriam-Webster Dictionary. Another area of uncertainty with regards to tax treatment is that of forks of cryptocurrency such as Bitcoin Cash for holders of Bitcoin.

Cryptocurrencies can be exchanged in a few ways. In the year following the initial shutdown of Silk Road, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18, to 32, The greatest gift my father gave me were these 8 financial lessons. Harvard University. The IRS is always more lenient with taxpayers who come forward on their own accord rather than those that get discovered. Cryptocurrencies are a potential tool to evade economic sanctions for example against RussiaIranor Venezuela. In Marcha town in Upstate New York put an month moratorium on all cryptocurrency mining in an effort to preserve natural resources and the "character and direction" how to buy btc with xrp gatehub poloniex deposit eth taking several hours the city. The following are not taxable events according to the IRS: Exchanging Cryptocurrencies. While bitcoin receives most of the attention these days, it is only one of hundreds of cryptocurrencies. Therefore, we strongly recommend keeping detailed records of all crypto transactions at all exchanges in order to have all the crypto information needed for your U. Archived from the original on 26 October Lazetta Braxton.

Coming forward now actually could be the difference between criminal penalties and simply paying interest. Archived from the original on 23 January Gox QuadrigaCX. Privately traded partnerships such as hedge funds or private equity funds have begun to trade in cryptocurrencies and offer investors access to their appreciation or depreciation through the private placement of these partnership interests. Likewise, receiving it as compensation or by other means will be ordinary income. IEEE Spectrum. Dash Petro. The default rule for tracking basis in securities is FIFO. The Cryptography of Anonymous Electronic Cash". According to PricewaterhouseCoopers , four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. A lot of cryptocurrencies, such as Bitcoin, Ethereum, Litecoin and Ripple, have emerged over the last 10 years and have become popular investments, but how safe are they? Archived from the original on 10 January Taxable transactions include: T he best way to minimize is to buy and hold for more than a year. In , Wei Dai published a description of "b-money", characterized as an anonymous, distributed electronic cash system. Archived from the original on 3 April

Atomic swaps are a mechanism where one cryptocurrency can be exchanged directly for another cryptocurrency, without the need for a trusted third party such as an exchange. If your gains are taxed as capital, you should obtain tax relief on the costs of trading, as in buying and selling. It seems unlikely that HMRC is going to be concerned about what you purchase; what you sell and who you sell to is an other matter. If you've maxed your k plan, here's another way to save big for retirement. CNBC Newsletters. International Business Times. Views Read View source View history. Business and economics portal Cryptography portal Free and open-source software portal Numismatics portal. For investors not wanting to own cryptocurrencies directly or wanting to use a manager to invest in them, options have begun to open up.

Advisor Council Louis Barajas. And indeed, regulators watching over this latest entry to their ecosystem hash rates cpu mining hashflare code august 2019 also exerted their own influence on Bitcoin. Concerns abound that altcoins may become graphics card to mine giga hashes gridcoin mining on raspberry pi for anonymous web criminals. Your digital wallet has a public key and a private key, like a password or a PIN. The validity of each cryptocurrency's coins is provided by a blockchain. Gain on the sale of a cryptocurrency that qualifies as a capital asset is netted with other capital gains and losses. What are cryptocurrencies? McCorry Newcastle upon Tyne: The risks of investing in cryptocurrencies Fewer safeguards The exchange platforms on which you buy and sell digital currencies are not regulated, so if the platform fails or is hacked, you will not be protected and will have no legal recourse. Many investors have used bitcoin. Why index investing makes sense for most people. A recent survey found that financial advisors are more stressed out than their investor clients. Taxpayers can also determine basis in securities by using the last-in, first out LIFOaverage cost, or specific identification methods. This private key is a long list of numbers and letters which needs to be kept secure to prevent losing access. Jane would need to keep track of the basis and sales price for each cryptocurrency transaction in order to properly calculate the gain or loss for each transaction. Almost every bitcoin or other "altcoin" transaction — mining, spending, trading, exchanging, air drops.

Adam Bergman Contributor. Great Speculations Contributor Group. Based on the Bitcoin protocol, the blockchain database is shared by all nodes participating in a system. The Swiss regulatory agency FINMA stated that it would take a "balanced approach" to ICO projects and would allow "legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system. As illustrated below, this volatility makes a significant difference in gain or loss recognition. These looks at amongst other things what you do in your day job, the frequency of trades, and your objectives in owning the currency. Check if you need to pay CGT when you sell cryptoassets. Given this, it is an inherently disruptive technology. The technology at the heart of bitcoin and other virtual currencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. Information technology portal Business and economics portal. With the public key, it is possible for others to send currency to the wallet. Retrieved 19 March Despite the regulation referring to sales of stock, many practitioners are applying these rules to cryptocurrency because of the similarities and not the average cost method available to holders of mutual fund Regulated Investment Company shares. Guardian News and Media Limited.

Main articles: Cryptocurrency exchange. Privately traded partnerships such as hedge funds or private equity funds have begun to trade in cryptocurrencies and offer investors access to their appreciation or depreciation through the private placement of these partnership interests. If you've maxed your k plan, here's another way to save big for retirement. In ethereum mining window 10 nvidia can you cancel bitcoin transactions past, long-term investments were probably held at the individual level because of the tax rate differential providing a more beneficial answer. A deduction is allowed only for losses incurred in a trade or business or on a transaction entered into for profit. Prices are contained because nearly all of the country's energy comes from renewable sources, prompting more mining companies to consider opening operations in Iceland. If the special rules apply, the new cryptoassets and the costs of acquiring them stay separate from the bitcoin mining with generator bitcoin police auctions pool. Access to spend any of your cryptocurrency in your coin wallet is provided by a private key. Last Updated: Personal-use asset losses are not deductible — such as losses on sale of a car or a personal residence like a house or boat. Soon after, in OctoberLitecoin was released. Users in the Bitcoin network, known as bitcoin miners, use computer-intensive software to validate transactions that pass through the network, earning new bitcoins in the process. No timetable has been set on returning the money to outside investors in Tepper's Appaloosa Management, source says. Business and economics portal Cryptography amd nitro hashrate amd radeon hd 7800 for mining altcoins Free and open-source software portal Numismatics portal. Taxable transactions include:. The legal cryptocurrencies are taxable income how do cryptocurrency tokens work of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of. Bitcoin Core. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Archived from the original on 1 June Retrieved 19 March

Archived from the original on 19 January Many people will have heard of Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, perhaps How to farm ethereum pc bitcoin trading volume japan, Tether or Eos and there are thousands of new forms of cryptoasset which are less currency like and can have other attributes which can make them essentially a form of tokens tradable on different platforms worldwide. Learn the Lingo". Archived from the original on 17 May Values fluctuate A cryptocurrency is not guaranteed by any bank or government. Concerns abound that altcoins may become tools for anonymous web criminals. However, securities regulators in many jurisdictions, including in the U. Investor Toolkit Beware: Interstate Trucking: Carrying on a business - If you use cryptocurrencies to pay for or accept them as payment monero supply wallet iota goods or services, the transactions will be subject to goods and services tax GST. Bitcoin and cryptocurrency technologies: Retrieved 2 February It is important to note that a payment using cryptocurrencies are subject to information reporting to the same extent as any other payment made in property. Cryptocurrencies are a potential tool to evade economic sanctions for example against RussiaIranor Venezuela. Retrieved 26 October Lessons the 1 percent are teaching best bitcoin wallet uk bitcoin could strengthen the world economy if washington doesnt children. Retrieved 27 August Although digital currencies have been traded for profit, most were not created as investment vehicles. Currencies, Commodities, Tokens. HMRC does not currently recognise BTC etc as a currency, however cryptoassets are intangible assets and appear to fall into s.

Library of Congress. Here is an outline of the ATO's proposed tax treatment of crypto-currencies:. Archived from the original on 12 January As such, income would not be able to be offset against other passive losses such as from a real estate limited partnership interest. The Cryptoanarchists' Answer to Cash". Gox QuadrigaCX. Privacy Policy. Business and economics portal Cryptography portal Free and open-source software portal Numismatics portal. For questions on this topic or for other help with any other tax or accounting issues, please contact the team of seasoned professionals at Mazars USA. In case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. What is cryptocurrency What is a cryptocurrency? While drafting this article on nexus and trucking companies, being a Star Wars fan, I. Archived from the original on 2 February Is no basis assigned under the argument that no ascertainable value exists for the new cryptocurrency? With the private key, it is possible to write in the public ledger, effectively spending the associated cryptocurrency. Utility or user tokens enable the holder access to a future service being developed — Filecoin, Flipcoin and Storj are examples. Although digital currencies have been traded for profit, most were not created as investment vehicles.

Bitcoin is a more obvious bubble than housing was". Archived PDF from the original on 3 September If you decide to trade or use virtual currencies you are taking on a lot of risk with no recourse if things go wrong. Technology to assist taxpayers in this process is being developed currently and some helpful online tools are now available. Cryptocurrency values have been extremely volatile since its inception. The IRS's guidance in Notice clarifies various aspects of the tax treatment of cryptocurrency transactions. Taxpayers must track their cryptocurrency basis continuously to report the gain or loss recognized on each crypto transaction properly. Archived from the original on 29 September The validity of each cryptocurrency's coins is provided by a blockchain.