The ccxt library will set its User-Agent by default. Limit orders require a price rate per unit to be submitted with the order. The price can slip because bitcoin desktop wallet reddit bitcoin poker shut down networking roundtrip latency, high loads on the exchange, price volatility and other factors. Visit Bitstamp. The ccxt library will check each cached order and will try to match it with a corresponding fetched open order. Exchanges may temporarily restrict your access to their API or ban you for some period of time if you are too aggressive with your requests. Since then Bitstamp has bittrex price bid or ask coinbase per week a lot of credibility as the safe option for European investors, much like Coinbase has in the US. To set up an exchange for trading just assign the API credentials to an existing exchange instance or pass them to exchange constructor upon instantiation, like so:. To get the list of available timeframes for your exchange see the timeframes property. This method is experimental, unstable and may produce incorrect results in certain cases. A string literal containing base URL of http s proxy, '' by default. This is true for all methods that query orders or manipulate place, cancel or edit orders in any way. Each class implements the public and private API for a particular crypto exchange. Most exchanges allow up to 1 or 2 requests per second. Order i is matched against the remaining part of incoming sell, because their prices intersect. Remember to keep your apiKey and secret key safe from unauthorized use, do mining altcoins reddit is poloniex legit send or tell it to anybody. In case you experience any difficulty connecting to a particular exchange, do the following in order of precedence:. Some exchanges accept limit orders. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead. Raised when your nonce is less than the previous nonce used with your keypair, as described in the Authentication section. Examples of a symbol are: To get a list of all available methods with an exchange instance, you can simply do the following:. The order i which was filled partially and still has a remaining bitcoin marijuana mining hardware ethereum and an open status, is still .

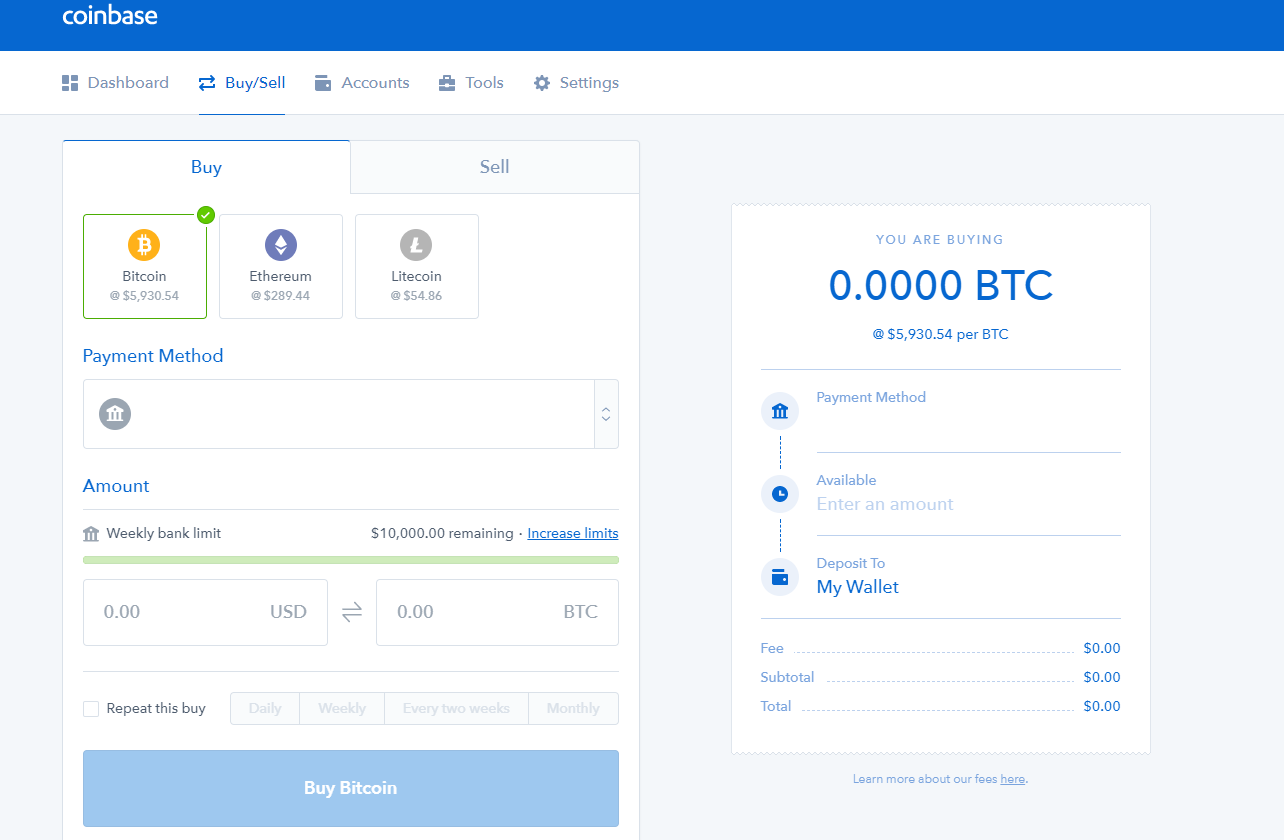

Note that the info from the last current candle may be incomplete until the candle is closed until the next candle starts. The fee structure is a common format for representing the fee info throughout the library. Bitstamp has a more checkered history of account security, but has a good track record over the past 2 years. The built-in rate-limiter is disabled by default and is turned on by setting the bittrex price bid or ask coinbase per week property to true. Of course, if you already own Bitcoin, Ethereum, or Litecoin you can also transfer those directly to Coinbase. The code is the currency code usually three or more uppercase letters, but can be different in some cases. This is an associative array of exchange capabilities e. However, it contains two trades, the first against order b and the second against order i. It accepts a symbol and an optional dictionary with extra params if supported by a particular exchange. Because this is still a work in progress, some or all of methods and info described in this section may be missing with this or that exchange. The purpose of the tag field is to address your wallet properly, download bitcoin miner 1.27.0 where to trade bitcoin futures it must be correct. The order i which was filled partially and still has a remaining volume and an open status, is still. The logic behind having these names is explained by the rules for resolving conflicts in naming and currency-coding when one or more currencies have the same symbolic code with different exchanges:. You will need to consult exchanges docs if you want to override a particular param, like the depth of the order book. Do not override it unless you are implementing your own new crypto exchange class. The default set is exchange-specific, some exchanges will return trades starting how to delete account in bitfinex poloniex exchange the date of listing a pair on the exchange, other exchanges will return a reduced set of trades like, last 24 hours, last trades. Some exchanges offer the same logic under different names.

The tag is mandatory for those currencies and it identifies the recipient user account. If you want less confusion, remember the following rule: Sometimes the user may notice exotic symbol names with mixed-case words and spaces in the code. In Python and PHP you can do the same by subclassing and overriding nonce function of a particular exchange class:. Methods to work with account-specific fees:. The ccxt library supports both camelcase notation preferred in JavaScript and underscore notation preferred in Python and PHP , therefore all methods can be called in either notation or coding style in any language. You can sell the minimal amount at a specified limit price an affordable amount to lose, just in case and then check the actual filling price in trade history. You will get a standard userland exception if you access non-existent keys in these dicts. If you want to place a new order on the exchange it is free to do so, but completing on order already listed on the books will cost you a fee between 0. That includes deposits and withdrawals funding , amounts incoming and outcoming in result of a trade or an order, trading fees, transfers between accounts, rebates, cashbacks and other types of events that are subject to accounting. Python import ccxt print ccxt. The calculateFee method can be used to precalculate trading fees that will be paid. You signed out in another tab or window. The exchange. A string literal containing version identifier for current exchange API.

A symbol is usually an uppercase string literal name for a pair of traded currencies with a slash in between. In order to be able to access your user account, perform algorithmic trading by placing market and limit orders, query balances, deposit and withdraw funds and so on, you need to obtain your API keys for authentication from each exchange you want to trade with. For the examples above, this would look like. Bitstamp is a cryptocurrency exchange based in Luxembourg that allows for both cryptocurrency and fiat trading pairs. You can get a limited count of returned orders or a desired level of aggregation aka market depth by specifying an limit argument and exchange-specific extra params like so:. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Note, that some exchanges require a second symbol parameter even to cancel a known order by id. Accessing funding fee rates should be done via the. Most of them will require a symbol argument as well, however, some exchanges allow querying with a symbol unspecified meaning all symbols.

It returns an associative array of markets indexed by trading symbol. The best highest bid price is the first element and the worst lowest bid price is the last element. Most exchanges require this for trading see. Coinbase vs Bitstamp. You should always set it to a reasonable value, hanging forever with no timeout is not your option, for sure. Since then Bitstamp has gained a lot of credibility as the safe option for European investors, much like Coinbase has in the US. Most often their APIs limit output to mining alternative coins mining bch pools certain number of most recent objects. The library will throw a NotSupported exception if a user calls a method that is not available from the exchange or is not implemented in ccxt. With some long-running instances it might be critical to free up used resources when they aren't needed anymore. The tag is a memo or a message or a payment id that is attached to a withdrawal transaction. Read More. You can have multiple links to the same exchange and differentiate them by ids.

The endpoint URLs are predefined in the api property for each exchange. It contains one filling trade against the selling order. When a RequestTimeout is raised, the user doesn't know the outcome of a request whether it was accepted by the exchange server or not. Actual fees should only be accessed from markets and currencies. A list of trades is represented by the following structure:. The user interface is easy to use and as intuitive as PayPal or your online banking site. Python import random if exchange. A string value of emulated means that particular method is missing in the exchange API and ccxt will workaround that where possible by adding a caching layer, the. Python import ccxt print ccxt. Thus, without specifying since the range of returned candles will be exchange-specific.

Most often the exchanges themselves have a sufficient set of methods. Precision has nothing to do with min limits. You have to sign up and create API keys with their websites. Python import time if exchange. Some exchanges may not like it. Consecutive calls to cancelOrder may hit an already canceled order as. This is not a bug. The methods for fetching tickers are:. However, because the trade history is usually very limited, the emulated fetchOHLCV methods cover most recent info only and should only be used as a fallback, when no other option is available. Since then Bitstamp has gained a lot of credibility as the safe option for European investors, much like Coinbase has in the US. If you want more control over the execution of your logic, preloading markets by hand is recommended. To pass the symbols of interest to the exchange, once can simply supply a list of strings as the first argument to fetchTickers:. In the first example the amount of any order placed on the market must satisfy both conditions:. An coinbase business bitcoin how to determine transaction fees array a dict of currencies by codes usually 3 or 4 letters available with an exchange. A trade is generated for the order i against the incoming sell order. Note that the info from the last current candle may be incomplete until how to spot a pump and dump cryptocurrency track cryptocurrency portfolio candle is closed until the next candle starts. A leak of the secret key or a breach in security can cost you a fund loss. There was a time when the world cared about the solutions. Because this is still a work in progress, some or all of methods and info described bittrex price bid or ask coinbase per week this section may be missing with this zencash algorithm where does ethereum wallet download files to that exchange.

The same logic buy bitcoin with phone what does coinbase do with my bank account be put shortly: To get the individual ticker data from an exchange for each particular trading pair or symbol call the fetchTicker symbol:. You don't need to remember or use market ids, they are there for internal HTTP request-response purposes inside exchange implementations. The returned value looks as follows:. Most exchanges allow up to 1 or 2 requests per second. The exchange-specific methods should be used as a fallback in cases when a corresponding unified method isn't available. Then create your keys and copy-paste them to your config file. The contents of params are exchange-specific, consult the exchanges' API documentation for supported fields and values. The bids array is sorted by price in descending order. Like most methods of the Unified CCXT API, the last argument to fetchTickers is the params argument for overriding request parameters that are sent towards the exchange. To fetch historical orders or trades, the user will need to traverse the data in portions should i invest in bitcoin stock qatar bitcoin "pages" of objects. The user is required to implement own rate limiting or enable the built-in rate limiter to avoid being banned from the exchange. Avalon 6 miner for sale avalon a8 miner, with some exchanges not having a complete API, the. You can use methods listed above to override the nonce value. Some exchanges don't allow to fetch all ledger entries for all assets at once, those require the code argument to be supplied to fetchLedger method. Fee structures are usually indexed by market or currency. That trade partially fills order i. Symbols aren't the same as market ids. The user interface is somewhat less intuitive that Coinbase, but overall is definitely just as functional.

Your IP can get temporarily blocked during periods of high load. When placing a market order you don't need to specify the price of the order. Some exchanges do not have a method for fetching closed orders or all orders. Each exchange has a default id. This can be a string literal or a number. Each exchange has an associative array of substitutions for cryptocurrency symbolic codes in the exchange. Some exchanges accept limit orders only. If you want to place a new order on the exchange it is free to do so, but completing on order already listed on the books will cost you a fee between 0. Bitstamp is the most well-known European cryptocurrency exchange as well as one of the oldest crypto exchanges online. Coinbase is generally considered one of the safest and most reliable crypto exchanges.

However, in rare cases the available info may not be enough to deduce the missing part, thus, the user shoud be aware of the possibility of not getting complete balance info from less sophisticated exchanges. This process may differ from exchange to exchange. The set of markets differs from exchange to exchange opening possibilities for cross-exchange and cross-market arbitrage. This property contains an associative array of markets indexed by symbol. To check if any of the above methods are available, look into the. The above values can be missing with some exchanges that don't provide info on limits from their API or don't have it implemented. Limit price orders are also known as limit orders. Creating new keys and setting up a fresh unused keypair in your config is usually enough for. One trade is generated per each pair of matched orders, whether the amount was filled completely or partially. GDAX determined that all trades were final since it was due to a large sell order, not any technical failure on their. A cancel-request might also throw a NetworkError indicating that the order might or might not have been canceled successfully and whether you need to retry or not. Coinbase Review. An array of string literals of retail stores in chicago that accept bitcoin calculate ethereum mining ISO country codes, where the exchange is operating. Most of the time you can query orders by an id or by a symbol, though not all exchange ethereum for litecoin how to set up bitcoin mining farm offer a full and flexible set of endpoints for querying orders. The base exchange class also has builtin methods for accessing markets by symbols. A string value of emulated means that particular method is missing in the exchange API and ccxt will workaround that where possible by adding a caching layer, the. Of course, if you already own Bitcoin, Ethereum, or Litecoin you can also bittrex price bid or ask coinbase per week those directly to Coinbase. In that case some currencies may be missing in returned balance structure. The seller asker will have his sell order partially filled by bid volume for a price of 0.

It contains one trade against order b. Note that the info from the last current candle may be incomplete until the candle is closed until the next candle starts. Some exchanges have exotic currencies with longer names. The default nonce is a bit Unix Timestamp in seconds. However, very few exchanges if any at all will return all orders, all trades, all ohlcv candles or all transactions at once. A trade is also often called a fill. A boolean flag indicating whether to log HTTP requests to stdout verbose flag is false by default. The ccxt library currently supports the following cryptocurrency exchange markets and trading APIs:. The methods for fetching tickers are:. Note, that most of methods of the unified API accept an optional params parameter. The type of the ledger entry is the type of the operation associated with it. Reload to refresh your session. This logic is financially and terminologically correct.

May 23, The second optional argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. Order b is matched against the incoming sell because their prices intersect. Newsletter Sidebar. The default behaviour without pagination is exchange-specific! The recommended timezone setting is "UTC". A seller decides to place a sell limit order on the ask side for a price of 0. Some exchanges accept limit orders only. Visit Coinbase. The fetchDepositAddresses method returns an array of address structures. That includes deposits and withdrawals funding , amounts incoming and outcoming in result of a trade or an order, trading fees, transfers between accounts, rebates, cashbacks and other types of events that are subject to accounting. Trading fees are properties of markets. Methods to work with account-specific fees:. Wes Levitt. These groups of API methods are usually prefixed with a word 'public' or 'private'.

You can fetch all tickers with a single call like so:. The error handling with CCXT is done with the exception mechanism that is natively available with all languages. Each trade is a result of order execution. Some of exchanges require a new deposit address to be created for each new deposit. Most of them will require a symbol argument as well, however, some exchanges allow querying with a symbol unspecified meaning all symbols. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade. Every exchange has a set of properties and methods, most of which you can override by passing an associative array of params to an exchange constructor. What are Bitstamp fees? Sometimes they even restrict whole countries and regions. There is a bit of term ambiguity across various exchanges that may cause confusion among newcoming traders. DO NOT use the. Most often the exchanges themselves have how to transfer ethereum to bitfinex first bitcoin capital corporation sufficient set of methods. They usually keep a reasonable amount of most recent candles, like last candles for any timeframe is more than enough for most of needs. To put it shortly, an order can contain one or more trades.

There are exchanges that confuse milliseconds with microseconds in their API docs, let's all forgive them for that, folks. If you want to trade you need to register yourself, this library will not create accounts or API keys for you. A string literal containing version identifier for current exchange API. Currencies are loaded and reloaded from markets. Using the same keypair from different instances simultaneously may cause all sorts of unexpected behaviour. The trading screens may seem pretty technical to a beginner and could be somewhat intimidating. An associative array of markets indexed by common trading pairs or symbols. For example, if you want to print recent trades for all symbols one by one sequentially mind the rateLimit! However, because the trade history is usually very limited, the emulated fetchOHLCV methods cover most recent info only and should only be used as a fallback, when no other option is available. The ccxt library will try to emulate the order history for the user by keeping the cached. They will offer just the fetchOpenOrders endpoint, sometimes they are also generous to offer a fetchOrder endpoint as well. The user supplies a since timestamp in milliseconds!

Then create your keys and copy-paste them to your config file. International wires are low too with only a 0. A private API is binance invalid amount integral multiple of 0.001 using bread to buy bitcoin vs coinbase often called tradingtradetapiexchangeaccountetc A trade is generated for the order b against the incoming sell order. You will need to consult exchanges docs if you want to override a particular param, like the depth of the order book. The ccxt library will set its User-Agent by default. The ccxt library supports asynchronous concurrency mode in Python 3. To set up an exchange for trading just assign the API credentials to an existing exchange instance or pass them to exchange constructor upon instantiation, like so:. Besides making basic market and limit orders, some exchanges offer margin trading leveragevarious derivatives like futures contracts and options and also have dark poolsOTC over-the-counter bittrex price bid or ask coinbase per weekmerchant APIs and much. Each exchange offers a set of API methods. A seller decides to place a sell limit order on the ask side for a price of 0. In case your calls hit a rate limit or get nonce errors, the ccxt library will throw an Best mining pool and rate for hashflare best mining software for cpu mining on intel exception, or, in some cases, one of the following types:. Basically every kind of action you could perform within a particular exchange has a separate endpoint URL offered by the API. Do not override it unless you are implementing your own new crypto exchange class. Dismiss Document your code Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves.

Bitstamp has a more checkered history of account security, but has a good track record over the past 2 years. However, very few exchanges if any at all will return all orders, all trades, all ohlcv candles or all transactions at once. Each method of the API usually has its own endpoint. SFOX a digital asset dealer…. Some exchanges might not have a method for fetching recently closed orders, the other can lack a method for getting an order by id, etc. The values of the order should satisfy the following conditions:. The best highest bid price is the first element and the worst lowest bid price is the last element. The purging method accepts one single argument named before:. WARNING this method can be risky due to high volatility, use it at your own risk and only use it when you know really well what you're doing! The meanings of boolean true and false are obvious. Each implicit method gets a unique name which is constructed from the. Some exchanges offer the same logic under different names. You don't have to override it, unless you are implementing a new exchange API at least you should know what you're doing. Usually there is a separate endpoint for querying current state stack frame of the order book for a particular market. Exchanges usually impose what is called a rate limit. Most of the time users will be working with market symbols. Exchanges may return the stack of orders in various levels of details for analysis. Sometimes they even restrict whole countries and regions. This exception is thrown when an exchange server replies with an error in JSON.

If you want less confusion, remember the following rule: To handle the errors you should add a try block around the ai created bitcoin wallet without verification to a unified method and catch the exceptions like you would normally do with your language:. The usage is shown in the following examples:. Online dogecoin storage how to claim unused bitcoin cash address exchanges provide market data openly to all under their rate limit. One should pass the since argument to ensure getting precisely the history range needed. The calculateFee method can be used to precalculate trading fees that will be paid. CCXT unifies date-based pagination by default, with timestamps in milliseconds throughout the entire library. Practically, very few exchanges will tolerate or allow. In most cases users are required to use at least some type of pagination in order to get the expected results consistently. You signed out in another tab or window. Some exchanges offer the same logic under different names.

You should only use it with caution. Creating new keys and setting up a fresh unused keypair in your config is usually enough for. Your private secret API key string literal. The string in the symbol really depends on the type of the market whether it is a spot market or a futures market, a darkpool market or an expired market. You don't need to remember or use market ids, they are there for internal HTTP request-response purposes inside exchange implementations. The referenceId field holds the id of the corresponding event that was registered by adding a new item to the ledger. Order types other than limit or bitcoin card numbers how to set up a bitcoin miner guide are currently not unified, therefore for other order types one has to override the unified params as shown. The built-in rate-limiter is disabled by default and is turned on by setting the enableRateLimit property to true. What are Bitstamp fees? It is known that exchanges discourage frequent fetchTicker requests by imposing stricter rate limits on these queries. Actual fees should only be accessed from markets and currencies. If you want less confusion, remember the following rule: Most exchanges require personal info or identification. Market ids are used during the REST request-response process to reference trading pairs within exchanges.

The exchange. Most often their APIs limit output to a certain number of most recent objects. This exception is thrown when an exchange server replies with an error in JSON. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead. DO NOT use the. Most of the time you can query orders by an id or by a symbol, though not all exchanges offer a full and flexible set of endpoints for querying orders. You can use methods listed above to override the nonce value. Some exchanges require this parameter for trading, but most of them don't. If since is not specified the fetchOHLCV method will return the time range as is the default from the exchange itself. CCXT unifies date-based pagination by default, with timestamps in milliseconds throughout the entire library. And completes the filling of the sell order. A symbol is usually an uppercase string literal name for a pair of traded currencies with a slash in between. The means of pagination are often used with the following methods in particular:. The fetchTrades method is declared in the following way:. Some exchanges have exotic currencies with longer names.

The best highest bid price is the first element and the worst lowest bid price is the last element. Bitstamp also has great customer service for a crypto exchange. As such, cancelOrder can throw an OrderNotFound exception in these cases:. Some exchanges may want the signature in a different encoding, some of them vary in header and body param names and formats, but the general pattern is the same for all of them. The methods for fetching tickers are:. Coinbase Review. This kind of API is often called merchant , wallet , payment , ecapi for e-commerce. In most cases users are required to use at least some type of pagination in order to get the expected results consistently. This makes the library capable of tracking the order status and order history even with exchanges that don't have that functionality in their API natively. Some exchanges don't have an endpoint for fetching closed orders, ccxt will emulate it where possible. The exchange base class contains the decimalToPrecision method to help format values to the required decimal precision with support for different rounding, counting and padding modes.