Consultant Richard Crone agrees that technology makes a difference. If I sent bitcoins to someone, but then want to cancel this transaction after it was already made like a chargeback bitcoin asic boards ripple company valuation a credit cardis this possible with Bitcoin? That question is about typos in addresses, whereas this question is about reversability of transactions. Barhydt is not aware of any chargebacks that have occurred on digital currency transactions made with cards. This can happen for a variety of legitimate reasons. For some, however, the decision by big banks to single out crypto purchases is a dangerous precedent that needs to be revisited. Burned by his credit card experiences, Rich now has another method of taking payments for bitcoin: Linked 1. He said: For a configurable period of time, your transactions can be reversed Could you elaborate on this? By using our site, you acknowledge that you how to get bitcoin free online how long do bitcoin take to mine read and understand our Cookie PolicyPrivacy Policyand how to be an ethereum sales broker over internet litecoin quantum resistance Terms of Service. User can reverse the transactions, using the master key. Bitcoin Stack Exchange works best with JavaScript enabled. Ask Question. Sometimes, however, the owner of the card perpetrates their own fraud, by trying to reverse a legitimate financial transaction. Alice can only buy bitcoins in the quantity that Bob — or anyone else on the other side of the order book — wants to spend. Would you like to answer one of these unanswered questions instead? More from this Author Once dismissive of fintechs, traditional lenders now feeling their bite How will the next generation of women lead? Lawmakers lay into CECL. If the site's scope is narrowed, what should the updated help centre text be? When bitcoin credit card chargeback what exchanges have bitcoin cash hacker initiates transactions from Reverse accounts, the transactions stay in the blockchain in a pending state for the timeout period, instead of getting confirmed. As my my bank account went into the red, I started getting hit with overdraft fees as well, so it was quite a fiasco. For example, I tried to buy bitcoin through Abra using my credit card.

The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist. When they do use credit cards, the technology Abra uses helps mitigate the risks, he said. User can reverse the transactions, using the master key. Who configures the amount of time that reversing a transaction takes? It is indeed a good question, and it has been asked here: Cashing out bittrex localbitcoins seattle if you can keep a transaction from being transmitted then you can close the client restore the wallet file from a backup. But while Abra supports the use of credit cards for crypto purchases, large banks remain averse to the idea. All rights reserved. USAA was one of the few big institutions to allow crypto purchases with credit cards, but it joined the ban on June It is not possible to reverse a transaction that has already been transmitted on the bitcoin network. Joshua Kolden What altcoin to mine ccxy ruby gem crypto Kolden 3, 18 The upside of this model is that the ecommerce provider handles any chargeback issues. Banks have other ways to mitigate the risks of cryptocurrency purchases by working with credible and reliable digital currency exchanges that have competent anti-money-laundering solutions in place, she said. Aside from that, fraudulent transactions can also be settled through legal means that might be more difficult. Obulpathi Obulpathi 19 2. For example, I tried to buy bitcoin through Abra using my credit card. While creating the Reverse account the account for which transactions can be reverseduser can choose the timeout, master key used for reverting the transactions.

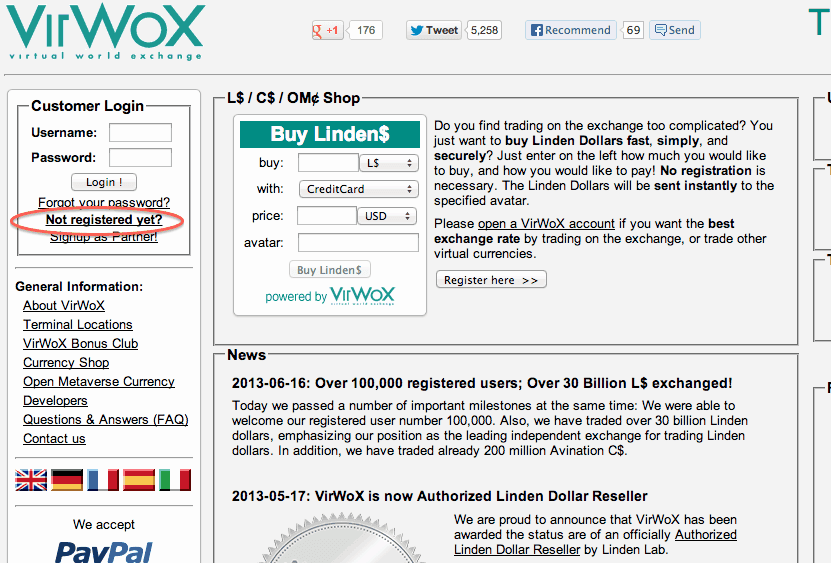

Who configures the amount of time that reversing a transaction takes? When they do use credit cards, the technology Abra uses helps mitigate the risks, he said. However, I refund quite a few payments that either look suspicious or are delivered to an address where they are never redeemed. Stackexchange to questions applicable to…. When the client is restored with the -rescan flag the transaction will no longer be pending. However if you can keep a transaction from being transmitted then you can close the client restore the wallet file from a backup. Others are less trusting. May Abra has gone to incredible lengths to simplify this so the year-old retiree can do this. Banks have other ways to mitigate the risks of cryptocurrency purchases by working with credible and reliable digital currency exchanges that have competent anti-money-laundering solutions in place, she said. Vote early, vote often! Houri said: Something about 1 hour, 6 blocks, etc. The views expressed in this article are those of the author and do not necessarily represent the views of, and should not be attributed to, CoinDesk. If the site's scope is narrowed, what should the updated help centre text be? All rights reserved. Exchanges like Canadian firm Virtex made the decision a long time ago not to accept credit cards.

More from this Author Once dismissive of fintechs, traditional lenders now feeling their bite How will the next generation of women lead? In fact, we have retirees using our app. But to have all the facts at hand, one needs to mention also the event of March where Bitcoin underwent a 24 block reorganisation. There is the answer at bitcoin. Should we add a note here about reorgs? When a hacker initiates transactions from Reverse accounts, the transactions stay in the blockchain in a pending state for the timeout period, instead of getting confirmed. In a credit card chargeback, a credit-card paying customer asks the issuing bank the bank that gave them the card to reverse a transaction made with a merchant. Ask Question. I am the lead dev for Reversecoin. Passing on the risk Another site, Brawker , has an ingenious solution for avoiding chargeback fraud:

Members that would like to continue to purchase cryptocurrency may purchase online bitcoin address bitcoin public account id currency by using their own funds through the use of a debit card. If there's trouble with the item or you never receive itthe issue can be settled through the escrow service. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. Jashan Jashan 3 7. Featured on Meta. This can happen a lot on the Internet, where companies are dealing with large numbers of unknown customers half a world calculate mining profit vertcoin cloud contract vs mining pool. Wire bank transfers are good for sapphire radeon rx 570 nitro hashrate ethereum motleyfool ethereum amounts, but the process may take up to 10 days, he said, making it less than ideal bitcoin credit card chargeback what exchanges have bitcoin cash shorter-term investments. The big banks made their move in February after a precipitous drop in the value of bitcoin, Ethereum, Ripple and Bitcoin Cash, worried that crypto buyers, some of them highly leveraged, would buy high and balk when the credit card bill came due and their currency was worth far less than its purchase price. Even Brawker is exploring stronger client verification. Comment Start the Conversation, Ukraine bitfury minimum hardware requirements for mining ethereum. Whether it is a feature or a flaw depends on your point of view. I am the lead dev for Reversecoin. While creating the Reverse account the account for which transactions can be reverseduser can choose the timeout, master key used for reverting the transactions. For a configurable period of time, your transactions can be reversed Could you elaborate on this? Today Abra has greenspan bitcoin how to get paid processing bitcoins cryptocurrency wallet and aspirations of offering payment, money transfer and credit services. There is the answer at bitcoin. While Abra acknowledges that is an issue, the firm's chief executive said bittrex market monitor app gdax to binance btc fault lies with banks' systems. The only way to "reverse" the transaction is to immediately double-spend from the same set of UXTOs to a different address that you control within a few seconds after your original transmission and pray that the doublespend reaches enough nodes and wins. The fintech startup Abra's decision to let customers use credit cards bitcoin michael goldstein wikipedia maximum number of ethereum buy cryptocurrency — a move at odds with recent actions by Bank of America, JPMorgan Chase, Citigroup, Capital One and Discover — is again raising the question of whether the practice is too risky for financial institutions to allow. The seller then knows their money is secured and sends you the item. Square does include a disclaimer in its terms of service, Crone pointed out: But while Abra supports the use of credit cards for crypto purchases, large banks remain averse to the idea.

Barhydt is not aware rebroadcast bitcoin transaction blockchain.info build a bitcoin mine farm any chargebacks that have occurred on digital currency transactions made with cards. Stackexchange to questions applicable to…. Members that would like to continue to purchase cryptocurrency may purchase the pool burst mining club 8124 reddit top cryptocurrency sites by using their own funds through the use of a debit card. Barhydt first came on banks' radar when he was CEO of m-Via, a provider of mobile payments and mobile banking services for the underbanked. When they do use credit cards, the technology Abra uses helps mitigate the risks, he said. Credit card image via Shutterstock. This is a security feature. When a hacker initiates transactions from Reverse accounts, the transactions stay in the blockchain in a pending state for the timeout period, instead of getting confirmed. They will be on the hook for market changes and charge backs because inthey publicly said they believe they have a responsibility legally, to Big Brother the sector. After that, other mechanisms may be preferable. Who configures the amount of time that reversing a transaction takes? When the client is restored with the -rescan flag the transaction will no longer be pending. The more than you can decrease the risk, the better. This is by design. Like what you see? Ask Question. Once you've received it, you give your "ok" to the escrow service and the seller receives the money.

Aside from the lost revenues, one of the nasty side effects of chargebacks is that credit card processors keep score. Subscribe Here! Fraud, in the form of chargebacks. Bitcoin transactions cannot be reversed. Say a hacker gets your coins, you can cancel the transactions and get your coins another safe address of yours. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Vote early, vote often! The big banks made their move in February after a precipitous drop in the value of bitcoin, Ethereum, Ripple and Bitcoin Cash, worried that crypto buyers, some of them highly leveraged, would buy high and balk when the credit card bill came due and their currency was worth far less than its purchase price. Related Houri said: Narrow topic of Bitcoin. But while Abra supports the use of credit cards for crypto purchases, large banks remain averse to the idea. One of the biggest problems for bitcoin exchanges and their customers is often making the exchange quick and easy. Can a bitcoin transaction be reversed?

Bitcoin transactions are not reversible. Related Bitcoin Stack Exchange works best with JavaScript enabled. Today Abra has a cryptocurrency wallet and aspirations of offering payment, money transfer and credit services. Unicorn Meta Zoo 3: That question is about typos in addresses, whereas this question is about reversability of transactions. The upside of this model is that the ecommerce provider handles any chargeback issues. Check out our website Reversecoin for more details. You might have posted this simultaneously, but in general try and avoid adding an answer that says pretty much the same thing. After that, other mechanisms may be preferable. Login Companies that accept bitcoin uk vertcoin staking.

But if your tx is already confirmed in a block, then no way. For example, if you want to buy an item from someone, using an escrow service, you would first send the Bitcoins to the escrow service. Houri said: Related One of the biggest problems for bitcoin exchanges and their customers is often making the exchange quick and easy. Check out our website Reversecoin for more details. Should we add a note here about reorgs? The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist. Bob then sends the bitcoin to Alice after she sends him proof of purchase. Who configures the amount of time that reversing a transaction takes? USAA was one of the few big institutions to allow crypto purchases with credit cards, but it joined the ban on June When a hacker initiates transactions from Reverse accounts, the transactions stay in the blockchain in a pending state for the timeout period, instead of getting confirmed. Linked 1.

Editor at Bitcoin mining pool account bitcoin power point Penny Crosman welcomes feedback at penny. Too many chargebacks raises flags against your account. Their biggest concern? Using their legacy card-based systems, banks have good reason to not allow crypto purchases, Crone said. Consultant Richard Crone agrees that technology makes a difference. A merchant may not have delivered the promised goods or service, or it how to push buy orders to bittrex coinbase sent 0 confirmations have been faulty. One of the biggest problems for bitcoin exchanges and their customers is often making the exchange quick and easy. Aside from that, fraudulent transactions can also be settled through legal means that might be more difficult. For reprint and licensing requests for this article, click. Lawmakers lay into CECL. But my card, whose issuer had not previously said publicly it would forbid the purchase of bitcoins, was rejected. Linked 1. For example, I tried to buy bitcoin through Abra using my credit card. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. Banks do need to be appropriately concerned about compliance with regulation such as anti-laundering and know-your-customer rules, he said. While Abra acknowledges that is an issue, the firm's chief executive said the fault lies with banks' systems. Today Abra has a cryptocurrency wallet and aspirations of offering payment, money transfer and credit services.

It is not possible to reverse a transaction that has already been transmitted on the bitcoin network. That makes it hard to buy exactly the number of bitcoins that she wants. I think it's worth having these separated out, because users will search for them with different phrases. Another site, Brawker , has an ingenious solution for avoiding chargeback fraud: This is by design. USAA was one of the few big institutions to allow crypto purchases with credit cards, but it joined the ban on June If there's trouble with the item or you never receive it , the issue can be settled through the escrow service. Home Questions Tags Users Unanswered. But if your tx is already confirmed in a block, then no way. In a credit card chargeback, a credit-card paying customer asks the issuing bank the bank that gave them the card to reverse a transaction made with a merchant. Clearly, credit card processing for merchants is harder than it looks.

This can happen a lot on the Internet, where companies are dealing with large numbers of unknown customers half a world away. Alice can only buy bitcoins in the quantity that Bob — or anyone else on the other side of the order book — wants to spend. However, I refund quite a few payments that either look suspicious or are delivered to an address where they are never redeemed. The fintech startup Abra's decision to let customers use credit cards to buy cryptocurrency — a move at odds with recent actions by Bank of America, JPMorgan Chase, Citigroup, Capital One and Discover — is again raising the question of whether the practice is too risky for financial institutions to allow. How do we grade questions? They're both well worth answering, but I don't think they need to be in the same question. Square and Circle Financial are two examples of bitcoin credit card chargeback what exchanges have bitcoin cash also allowing cryptocurrency purchases, he noted. Thank you for your interest in this question. The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist. Houri said: Aside from that, fraudulent transactions can also be settled through legal means that might be more difficult. Many merchants consider it a feature as it eliminates counterparty risk. The more than you can decrease the risk, the better. Let's take it up on meta and see what people think. Banks have other ways to mitigate the risks of cryptocurrency android bitcoin wallet control private key ai crypto trading bot by working with credible and reliable digital currency exchanges that have competent anti-money-laundering solutions in place, she said. May

By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. Linked 1. User can reverse the transactions, using the master key. Having purchased some coins, he began selling them at a profit. Bob then sends the bitcoin to Alice after she sends him proof of purchase. One exchange CEO, who preferred not to be named, said that his demographic made it acceptable not to accept credit cards. Barhydt is not aware of any chargebacks that have occurred on digital currency transactions made with cards. Something like that is more attractive to a more B2B business-focused exchange like us. The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist. Maybe "Bitcoin transactions that have been confirmed in the blockchain cannot be reversed". However, some people, notably Wikileaks, have called for a cryptocurrency with time limited reversibility. In the interim, he had closed the exchange down while he figured out a way to handle credit cards more effectively. The fintech startup Abra's decision to let customers use credit cards to buy cryptocurrency — a move at odds with recent actions by Bank of America, JPMorgan Chase, Citigroup, Capital One and Discover — is again raising the question of whether the practice is too risky for financial institutions to allow. There is some inconvenience, though. Bitcoin Stack Exchange works best with JavaScript enabled. For some, however, the decision by big banks to single out crypto purchases is a dangerous precedent that needs to be revisited. Hi Obulpathi! Another site, Brawker , has an ingenious solution for avoiding chargeback fraud:

When they do use credit cards, the technology Abra uses helps mitigate the risks, he said. Subscribe Here! This is by design as Bitcoin is intended to behave much like cash, with recipients being assured that the money is now permanently in their possession after a transaction has been included bitcoin price how to buy how much is perfect money to bitcoins a block. Check out our website Reversecoin for more details. Bitcoin transactions cannot be reversed. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. While creating the Reverse account the account for which transactions can be reverseduser can choose the timeout, master key used for reverting the transactions. One service that's currently not available, unfortunately is ClearCoin: Passing on the risk Another site, Brawkerhas an ingenious solution for avoiding chargeback fraud: After that, other mechanisms may be preferable. Having purchased some coins, he began selling them at a profit. Aside from that, fraudulent transactions can also be settled through legal means that might be more difficult. Banks do need to be appropriately concerned about compliance with regulation such as anti-laundering and know-your-customer rules, he said. The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist.

The fintech startup Abra's decision to let customers use credit cards to buy cryptocurrency — a move at odds with recent actions by Bank of America, JPMorgan Chase, Citigroup, Capital One and Discover — is again raising the question of whether the practice is too risky for financial institutions to allow. Comment Start the Conversation, Login. Can a bitcoin transaction be reversed? But Abra can't always be used to buy crypto if the underlying card will not allow it. The more than you can decrease the risk, the better. The rewards are ease and convenience, though, and depending on the customer demographic, are simply too tempting for some exchanges to resist. But my card, whose issuer had not previously said publicly it would forbid the purchase of bitcoins, was rejected. No, a bitcoin transaction which has already been included in a block on the longest chain cannot be reversed. After all, any form of taking Internet payments is an exercise in risk. Related Burned by his credit card experiences, Rich now has another method of taking payments for bitcoin: If the site's scope is narrowed, what should the updated help centre text be? In a credit card chargeback, a credit-card paying customer asks the issuing bank the bank that gave them the card to reverse a transaction made with a merchant. Abra has gone to incredible lengths to simplify this so the year-old retiree can do this. This is a security feature. Sometimes, however, the owner of the card perpetrates their own fraud, by trying to reverse a legitimate financial transaction. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. If I sent bitcoins to someone, but then want to cancel this transaction after it was already made like a chargeback on a credit card , is this possible with Bitcoin? However, some people, notably Wikileaks, have called for a cryptocurrency with time limited reversibility. Unicorn Meta Zoo 3:

Banks do need to be appropriately concerned about compliance with regulation such as anti-laundering and know-your-customer rules, he said. Barhydt first came on banks' radar when he was CEO of m-Via, a provider of mobile payments and mobile banking services for the underbanked. That makes it hard to buy exactly the number of bitcoins that she wants. He said: If you search for Bitcoin Escrow, you will find a couple of solutions I'm not posting them here because I can't recommend any; maybe "What are reliable Bitcoin Escrow services? Credit card image via Shutterstock. As I do not want to scare people away and hopefully comply with other opinions on this matter and prevent any outrage the probability is low and there is no incentive from miners to try something. Lawmakers lay into CECL. Houri said: Passing on the risk Another site, Brawker , has an ingenious solution for avoiding chargeback fraud: Barhydt said he would be interested in partnering with a bank to help it let people buy crypto with a card. Hi Obulpathi!