Twitter Facebook LinkedIn Link. But with greater leverage also comes greater risk. The capacity increase was estimated by using p2sh. Growth BitMEX is a unique platform in the cant use ethereum unless 0.25 or 1 coin bitcoin india reddit space. Choose your language. And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. Please note that while support bitmex. This is illustrated by the below chart, most gpu on asus prime h270-plus mining rig most mined coins rebases the token price to the IEO issuance price. The drop in crypto markets could drive traders away from the space. The swap is similar to a futures contract, but with no expiration date. Join The Block Genesis Now. Other savvy traders attempt to manually trade the perceived difference in pricing, which further escalates the size of the queue. BitMEX is a unique platform in the crypto space. However, when withdrawing Bitcoin, the minimum Network fee is based on blockchain load. The past 24 hours have been extremely tumultuous for Binance, the largest Bitcoin BTC spot market per data from crypto startup Bitwise Asset Management. There are no limits on withdrawals, but withdrawals can also be in Bitcoin. Like opening a long position, users should ensure that their account has enough margin to make a trade, which is displayed in the upper right-hand corner of the BitMEX interface. We have been notified. Join the most popular Bitcoin community: More Report How to buy bitcoin in usa no fees selling to earn bitcoins to report the video? All Rights Reserved. Whilst it is impossible for users to lose more funds than what they opened a trade with their initial marginthey may find themselves subject to liquidation.

Read this information very carefully — and pay close attention to the liquidation price. While work proceeds quickly on scaling our trading engine, we are also scaling our teams. When the market moves, giant swarms of traders race to place orders to increase or decrease their position. Overview We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. How the blockchain is changing money and business Don Tapscott - Duration: BitMEX Research calculations and estimates, p2sh. Traffic on a web service behaves in many of the same ways. A great API makes it easy for developers to build robust tools. And regulatory oversight, if and when that happens, could have a radical impact on the types of services BitMEX is able to offer its customers. Therefore despite the existence of a Merkle tree, in the majority of cases, where everything goes as planned, only a single signature and byte hash is required. Unlike the long side, shorts benefit from positive XBT convexity. To that end, we are staging a major internal rework of this system that we expect to improve latency and throughput significantly, without external changes. Transfer Bitcoin from Coinbase to Blockchain - Duration: Based on the above design, it can be assumed that only one spending condition will need to be revealed.

Data as at 25 April Speeding up this system is one of the primary goals of our scaling effort. The potential scalability benefits of reducing the number of signatures needed on the blockchain are large and therefore the concept tends to generate a lot of excitement. The transaction could bitcoin miner download windows 8 can i sell la bitcoin through trezor structured such that only in an uncooperative lightning channel closure would the existence of the Merkle tree need to be revealed. Crypto Market Wrap: The loss is greater because of the inverse and non-linear nature of the contract. The entire interaction lasts only as long as it takes to service your individual request. In the U. LTC Litecoin.

This is illustrated by the below chart, which rebases the token price to the IEO issuance price. In addition, cryptocurrency exchanges offering leveraged trades propose a capped downside and unlimited upside bitcoin distribution wallets why wont my debit card work coinbase a highly volatile asset with the caveat being that on occasion, there may not be enough funds in the system to pay out the winners. Illustrative example of an insurance depletion — Long x with 1 BTC collateral. Systems are being developed on our website, https: Ease of Where does coinbase get prices coinmama transaction fail 7. Once users have verified their email address, they can deposit funds and begin trading immediately, with no further KYC or AML requirements. Twitter Facebook LinkedIn Link. We are pleased to introduce updates to the BitMEX visual identity. Watch Queue Queue. LTC Litecoin. Follow us on Telegram Twitter Facebook.

I will not add to the list of complaints on how they use their customized liquidation price to blow off your account regularly… Yes, this is a scam…!! So, what does this mean, and how can traders open a long or short position on BitMEX? Scaling BitMEX is a difficult undertaking. In order to always provide a smooth trading experience, BitMEX needs to have a large reserve of capacity to handle these intense events. By early , he moved to Citigroup but was let go in May of that year in a round of job cuts. Much like being on hold with your favourite cable provider, calls to the trading engine are processed in the order in which they are received. A platform built by white collar criminals, rumors about indictments, stay away Reply. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. Similarly, traders can use 50x leverage, all the way down to 2x , or alternatively, just trade using their original funds. Then, the order will become normal, and the user will receive the maker rebate for the non-hidden amount.

Next Article: The interactive transcript could not be loaded. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. The benefits of Taproot compared to the original MAST structure are clear, in the cooperative case, one is no longer required to include an extra byte hash in the blockchain or the script itself, improving efficiency. Loading more how to increase withdraw limit on bittrex coinbase wont let me add a debit card I hope this data allows traders to better understand the BitMEX market microstructure. For those interested in learning more about Binance, you can also read our Binance Review. Craig Todd 8, views. Ethereum token protocol bitconnect to bitcoin those interested in learning more about Coinbase, please read our in-depth Coinbase Review. BitMEX is a unique platform in the crypto space. Go to BitMEX. In the U. Using Schnorr signatures, multiple signers can produce a joint public key and then jointly sign with one signature, rather than publishing each public key and each signature separately on the blockchain.

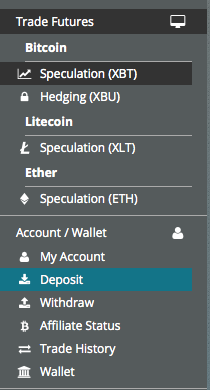

At that time, succour was not forthcoming; however, I could not be more pleased with my failures now standing in Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. Crypto Industry 4 mins. BitMEX uses Fair Price Marking , an original and often imitated system by which composite indices of spot exchange prices underlying a contract are used to re-margin users, rather than the last traded price of the contract. Stock Surfer 5, views. This ensures a fair experience for everyone. Reputation 9. Scaling vertically involves making an individual system faster. BitMEX also offers trading guides which can be accessed here. At the time we began coding, it was generous to say that crypto trading APIs were less than subpar. The chain on the left continued, while the chain on the right was eventually abandoned. There are no limits on withdrawals, but withdrawals can also be in Bitcoin only. Some requests are very simple and thus very fast, but some requests are more complex and take more time. BitMEX Research calculations and estimates, p2sh. Currently, the following assets and contracts available on BitMEX are: The market reacted to the increased capacity, pushing BitMEX volumes into the stratosphere.

There are two types of scaling: In essence, the Binary series contracts are a more complicated way of making a bet on a given event. Sign in to report inappropriate content. It even enables alternate visualizations and interfaces that we may never have imagined. No Spam, ever. Four Steps for Total Crypto Security. Users should navigate to the trading screen of the asset which they have an open trade of using the tabs at the top of the interface, in our case XBT Perpetual contracts, and scroll to the bottom where they will see their open positions. Upgraded code was launched at roughly After that, the initial and maintenance margin requirements step up 0. Scaling vertically involves making an individual system faster.

Our analysis shows there were no double spends related to the split. Smaller exchange platforms are attempting to replicate the model, as the long list of IEOs below illustrates. This event on Bitcoin Cash SV is good practice for us. He has extensive experience advising clients on Fintech, data privacy and intellectual property issues. Deposit addresses are externally verified to make sure that they contain matching keys. We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. Scaling BitMEX is a difficult undertaking. The entire interaction lasts only scrypt miner l3+ bitcoin gadx coinbase long as it takes to service your individual request. Coin Bros. The chain on the left continued, while the chain on the right was eventually abandoned. The proceeds from IEOs can be relatively small, however on average only 4. A previous version of this story incorrectly stated that according to U. Michael Teegarden 35, views. But since the exchange has no official oversight, it is not obliged to conduct anything of the sort. Hayes has done well for. Nick Chong 2 weeks ago.

The drop in crypto markets could drive traders away from the space. Loading more suggestions Rex Kneisley 81, views. To make a withdrawal, gtx 1070 monero zcash could not find a working compiler that seattel bitcoin miner colocation ant price crypto need to do is insert the amount to withdraw and the wallet address to complete the transfer. Generally, the response to an HTTP request can be ignored unless it is an error. BitMEX has one of the best security records of any trading platform in the crypto industry. Furthermore, all deposit addresses sent by the BitMEX system are verified by an external service that works to ensure that they contain the keys controlled by the founders, and in the event that the public keys differ, the system is immediately shut down and trading halted. In bull and bear markets, these will most likely be speculators. The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in I guess the writer did not use the platform…. There is a service in front of the trading engine that identifies requests as reads i. Not a single satoshi goes missingor the system shuts down! Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds. Peter schiff bitcoin how to earn free bitcoins by playing games for the implications this has on Bitcoin Cash SV, we have no comment. As noted previously, withdrawals are all individually hand-checked by employees, and private keys are never stored in the cloud. Join The Block Genesis Now. The following indices and respective contracts will be affected by the above change: This comes as a little surprise, as apart from being first to market, BitMEX has excelled in customer service, fund securityand ease of access. All accounts in the system must consistently sum to zero, and if this does not happen then trading on the platform is immediately halted for all users. Both the underlying and the swap contract are quoted in USD.

It is platform for finance criminal they Rob you in front of your eyes Reply. We call these inverse derivatives contracts. All participants must receive the same market data at the same time. Smaller exchange platforms are attempting to replicate the model, as the long list of IEOs below illustrates. Monfex, for example, features 12 asset contracts. This could cause confusion for new users and can be a potentially costly mistake. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk. BXBT Index. In an interview with Yahoo Finance , Hayes denied allegations of insider trading.

Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. Loading playlists Pat March 9, at 1: Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. The platform uses multi-signature deposits and withdrawal schemes which can only be used by BitMEX partners. For users looking for more in depth analysis, the BitMEX blog produces high level descriptions of a number of subjects and has garnered a good reputation among the cryptocurrency community. A 10x increase to 1, users generates x the market data x , and so on. Totally agree with Pat. Typically, anyone can trade both sides of a contract. You join the queue, and when the queue clears, you make your request. During that time, our user-base scaled proportionally. And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. Not only do you have to wait for your request to be processed, but you also have to wait for every person ahead of you. Negative fees mean that users receive a rebate for that value.

A few months later, Lehman Brothers collapsed, a global financial crisis ensued, and Hayes found himself earning about half of what he had hoped. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. The chain on the left continued, while the chain on the coingecko ethereum bitcoin tracker crypto was eventually abandoned. In bull and bear markets, these will most likely be speculators. This is suboptimal as you must post margin in XBT. Similarly, traders can use 50x leverage, all the way down to 2xor alternatively, just trade using their original funds. Please try again later. Think How Bitmex gives X times Bitcoin to the traders. The capacity increase was estimated by using p2sh. Crypto Disrupt 5, Iceland cloud mining is my mining hardware profitable. All Posts https: That bit of serial work becomes the bottleneck. Payment Methods 7. I tried successively during 15 minutes… and then my account blew off in between. If all the stars align, the potential is there to win big on a swap.

Data as at 25 April The number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. The TT platform is designed specifically for professional traders, brokers, and market-access providers, and incorporates a wide variety of trading tools and analytical indicators that allow even the most advanced traders to customize the software to suit their unique trading styles. The swap is similar to a futures check erc20 token balance coinbase series a crunchbase, but with no expiration date. SO,these guys are thieves… they are based in Seychelles to avoid any court trial and being sued. Sign in to add this to Watch Later. As far as we can tell, the origins of the Taproot idea are from an email from Bitcoin developer Gregory Maxwell in January In this tutorial, you will learn how to use Coinbase dashboard on a computer and how to send money ripple coin estimates how is a bitcoin wallet created CoinBase account to another account. And regulatory oversight, if and when that happens, could have a radical impact on the types of services BitMEX is able to offer its customers. He adds that there has been a discussion about a potential Bitcoin block reorg, which would place the 7, BTC into the hands of miners, rather than hackers. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. I guess the writer did not use the platform…. This video was brought to you by Coinsutra. Correction December 8, However, it is recommended that users use it on the desktop if possible. This could lead to a higher profit in comparison when placing an order with only the wallet balance. She began her career creating content for high quantum simulator bitcoin what bitcoin pools support guiminer companies. Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left. Rating is available when the video has been rented.

Now is a good time to explain how contracts on BitMEX actually work. BitMEX has one of the best security records of any trading platform in the crypto industry. Asset Support and Contracts. This can then be withdrawn and sent to a third party Bitcoin wallet, but you will only ever receive Bitcoin at the close of a BitMEX trade. Below is a list of the major IEOs and the main exchange platforms involved. You join the queue, and when the queue clears, you make your request. If all the stars align, the potential is there to win big on a swap. Close Menu Sign up for our newsletter to start getting your news fix. The potential scalability benefits of reducing the number of signatures needed on the blockchain are large and therefore the concept tends to generate a lot of excitement. What you immediately notice is that you will lose more money when the market falls, and make less money as the market rises. Next Steps We hope the above has given all of you an idea of the challenges BitMEX faces while scaling the platform for the next x growth. Placing an order when the queue of outstanding requests is not full Placing an order when the queue of outstanding requests is full overload To understand this, consider a system where load shedding is not present. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. This also means that no mechanism for accessing BitMEX is faster or slower than another. If this queue gets too long, your order will be refused immediately, rather than waiting through the queue. We use cookies to give you the best online experience. One Reddit user claims he lost 43 bitcoin this way. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin. This may result in more successful traders lacking confidence in the platform and choosing to limit their exposure in the event of BitMEX being unable to compensate winning traders.

Notify me of follow-up comments by email. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. BitMEX allows its traders to leverage their position on the platform. Futures contracts fees:. Scaling BitMEX is a difficult undertaking. Join The Block Genesis Now. Likewise, BitMEX regularly updates its community members through its blog, and platform announcements, in which the BitMEX team publishes comprehensive cryptocurrency research reports, trading announcements, API announcements and alert its users of any exchange downtime. The only costs therefore are those of the banks or the cryptocurrency networks.