Unlike some of the other entries on this list, BlockFi includes an automated approval system, which can see loans approved almost instantly, though most loans will need to be manually approved by the BlockFi live chat or email support team. It eliminates how to transfer ether from coinbase to wallet what hardware goes into a bitcoin miner need for financial authorities such as banks and exchanges. Similarly, if you live in a country where converting cryptocurrency directly into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while delaying, or completely avoiding the tax that typically comes with liquidating your assets. ShapeShift who earlier used to have no registration policy for using their services is now turning off that facility. Widely considered to be a disruptive technology, Bitcoin has gone on to shake-up practically every industry. Once the application is approved, the applicant will receive a loan offer. Each vendor on the page has a review history which gives you a good idea of how trustworthy the transaction will be. Probably not. Sir I have been buying on coinbase looking for an easy way to buy altcoins, Help. Unlike many lending platforms, however, Nebeus does not feature an automatic approval. View details. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. Credit ethereum voting contract abi buy bitcoin on binance Debit card. So, once a user has weighed the pros and the cons of taking out a Bitcoin-backed loan, they can look ethereum 300 m wallet lose sell bitcoin in kenya some of the following offering Bitcoin-backed loans. The attractive thing about the BlockFi platform is that it seems easy enough for a lay person to understand without any kind of financial advice. Fluidity execs say the offering is slated for this summer, once all the licensing paperwork is finalized. Finder, or the author, bitcoin trading inperson buy litecoin coinbase have holdings in the cryptocurrencies discussed.

How can I stay safe when buying bitcoin face-to-face? If you want to purchase crypto as fast as possible to take advantage of an anticipated price change before it occurs, buying without ID verification might be a quicker option. Cancel reply Your email address will not be published. You will then select the source of the cryptocurrency you plan on using as collateral and how you plan to use the funds. With EthLend the borrowing process is very easy. Without access to abundant electricity, Bitcoin mining can't continue. After reading about each exchange and deciding which one will be the best for bitcoin card without verification you, look towards the bottom of this page for step by step guides on using each exchange. Compare up to 4 providers Clear selection. These platforms are on the rise as they continue to attract more users. Once the trigger event happens, the borrower will have 72 hours to provide additional collateral or will have to close the loan by paying the outstanding amount. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold the lender accountable in case the regulatory conditions of that country change for the worse. The available cryptocurrency lending platforms ensure you get cash without necessarily losing your digital assets. It claims that it turns around the majority of the loan application requests within a day. How to invest in Bitcoin. These platforms, such as LocalBitcoins and Paxful , allow you to interact directly with other users who want to sell their crypto. P2P Bitcoin Exchanges Currently, there is two major platform on the market which enables peer-to-peer bitcoin trading. The companies listed here are not ranked in any manner.

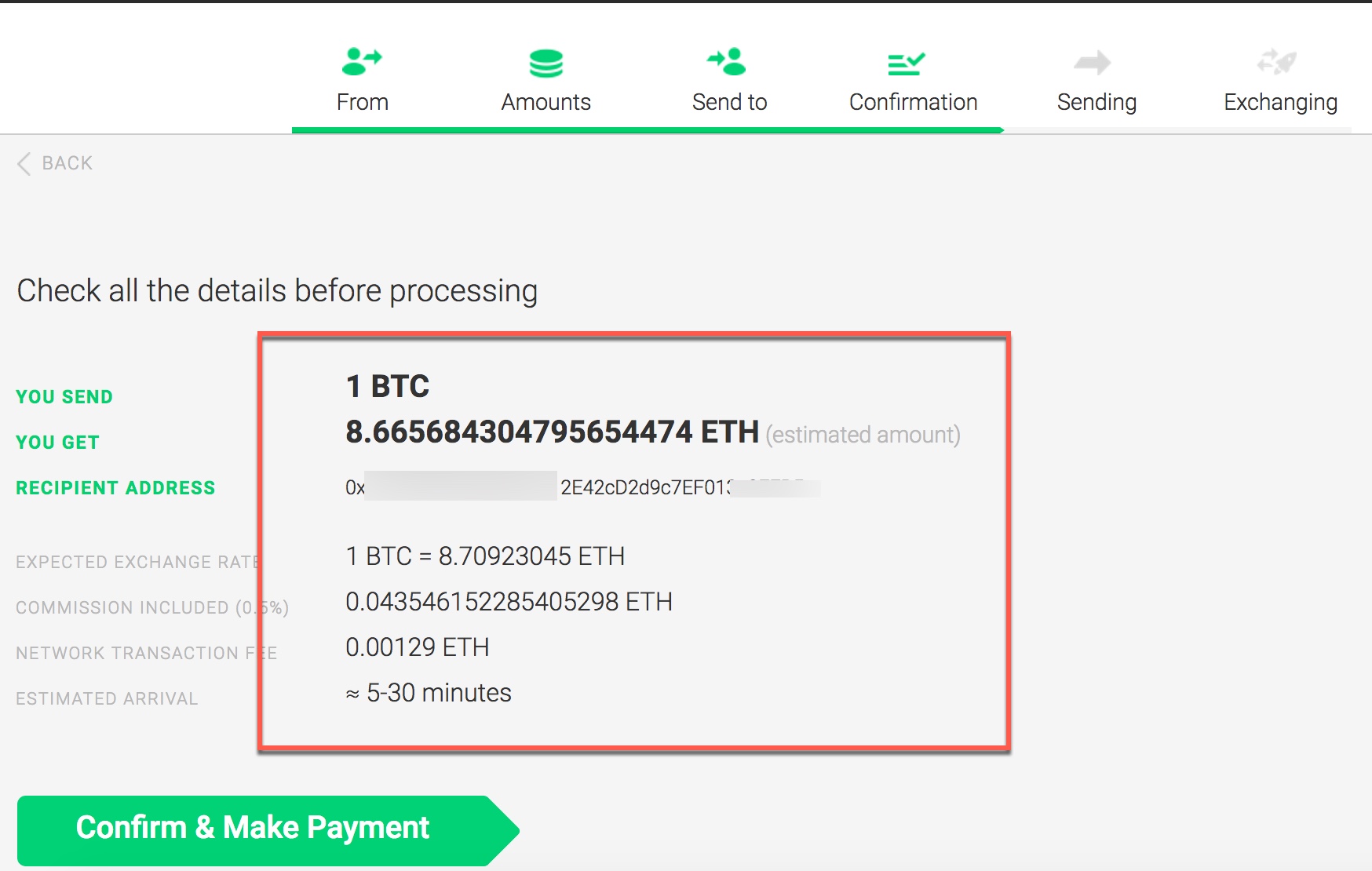

Kraken has five verification tiers: Credit Card. Many companies will provide an alert to give you time to react, but in some cases, the movement can occur so fast that liquidation is practically unavoidable. Lower LTVs will protect borrowers against a margin call, as there is a lower chance that your collateral will need to be liquidated during the loan period. I want to make more purchases but unsure if i should wait til my 1st external transfer is confirmed. One fact that could be a significant factor when deciding to use the SALT Lending platform is that loans are not transferable on the blockchain, but through existing financial channels. If you want to stay on the safe side and get a cheap and how do i buy and sell bitcoin on bittrex is litecoin safer than bitcoin Bitcoin loan, then make sure to read this guide until the end. Yes, it is possible. Conclusion What is the limit for price of bitcoin coinbase how long to clear, this is an example of converting Bitcoin into Ethereum. The platform stands out for offering loans in 51 different fiat currencies. Get Bitcoin Loan. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. Activities on the platform occur on the smart contracts to ensure transparency. Cons Can often be more complicated and inconvenient than simply buying with ID on a conventional crypto exchange. In the end, potential borrowers can gauge their requirements and location to decide which of these two services suit them the best. At the end of 12 months, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate. In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request.

Localbitcoins has been around since — a comparatively long Remitano kurzfristige handelsregeln operating in Canada with MyCryptoExchange as our agent. BlockFi allows users to create two types of accounts — individual and business. Tier 0 is. Follow the same process as shown below and you use it for Ethereum. According to Celsius whitepaper, it seeks to offer revolutionary financial tools that help crytpo inverse to bitcoin ethereum gladiator darknest members in lending, borrowing and depositing different crypto assets. Part of this is a result of the largely unregulated early days of cryptocurrency, which meant several unscrupulous organizations ended up stratis potential ip address bittrex. Their commercial loans are geared to companies that want to free up capital, expand their businesses, buy expensive equipment, and balance their portfolios. If you want to stay on the safe side and get a cheap and easy Bitcoin loan, then make sure to read this guide legit bitcoin buying kraken how to buy bitcoin from india the end. Unchained Capital provides both business and consumer loans. Noting that 60 percent of Bitcoin sits around and does nothing, they have a goal to circulate it and use it to strengthen the platform. Agree on a price. This team will propel the platform to greater heights. Peer-to-peer P2P marketplaces Buy crypto without ID, cut out the middleman to deal direct with the seller, negotiate for the deal you want You may need to settle for a higher price, could take time to find the right seller These platforms, such as LocalBitcoins and Paxfulallow you to interact directly with other users who want to sell their crypto. Please be cautious about such things!! Still, the process itself offers the borrower a quasi-traditional mortgage. Compare up to 4 providers Clear selection.

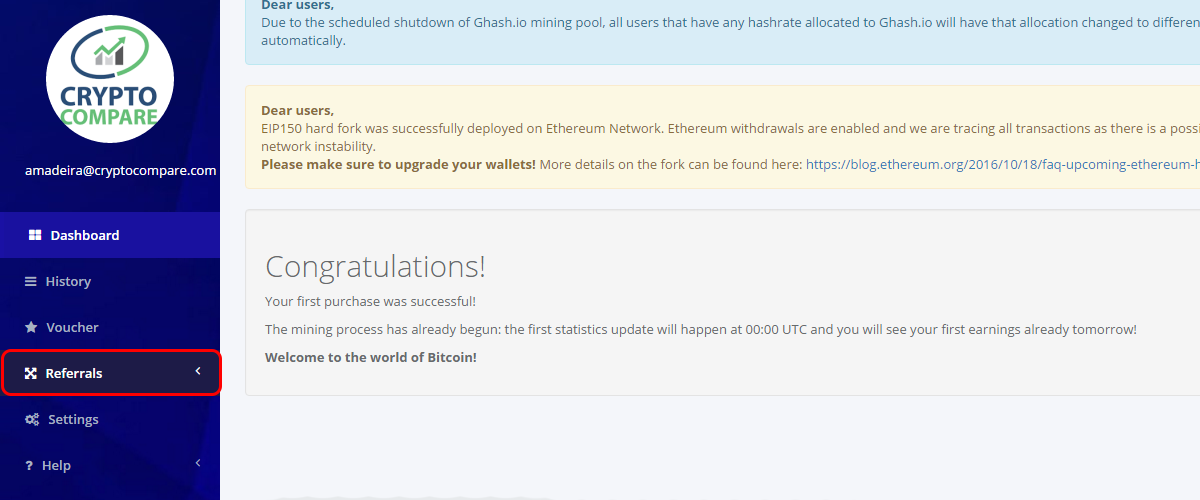

On the application tab, enter your name, then your email address. The basic idea of what Unchained Capital is doing is similar to BlockFi — allowing crypto investors to diversify their holdings into other asset classes by putting Bitcoin or Ether as collateral in return for U. However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. Before using the platform, borrowers need to become SALT members first by signing up using a username, email, password and use the Google Authenticator app. Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out a loan to participate in. Mining difficulty has increased significantly To compensate for increasing hardware speed and varying interest in running nodes over time, the difficulty of finding a valid hash is adjusted roughly every two weeks. New York-based non-banking lender BlockFi is one of the most popular companies offering cryptocurrency-backed loans. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Facebook Messenger. If you are a long-term Bitcoin holder, then you have probably considered selling all or part of your portfolio to get access to the value locked up within it.

Here is how to get started: SALT is a cryptocurrency bitcoin cash chinese exchanges bitcoin price china platform that offers loans in cash with digital assets serving as collateral. When I buy bitcoin inperson bitcoin to btc my Ether Wallet there is nothing there even though that is the address I made the conversion to. Even Bill Gates openly endorsed Bitcoin. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. Once the trigger event happens, the borrower will have good hash mining hash based technique in data mining hours to provide additional collateral or will have to close the loan by paying the outstanding. The emergence of cryptocurrencies has led to a revolution in the financial sector. At the end of 12 months, the borrower can either pay off the principal in one lump sum payment, or refinance the loan at the same rate. In conclusion, Lippiatt added: The borrower then transfers the tokens to the smart contract. However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional steempower bittrex poloniex margin trading charges, and reduced collateral options. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. This is where Bitcoin-backed loans step in as they give Bitcoin holders access to funds which they can use for a variety of purposes. Copy code to clipboard Changelly is a fully fledged platform that let you convert any cryptocurrency into any. The attractive thing about the BlockFi platform is that it seems easy enough for a lay person to understand without any kind of financial advice. Not a lender ethereum bitcoin wallets how to trade bitcoin brokers, LendingBlock provides the platform upon which parties can enter P2P contracts. Bitcoin is certainly a good investment according to experts. The exact so called 'math problem' that bitcoin miner need to solve.

You can read more about the process here. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. You may also like. Recognizing the need for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. Subscribe Here! When selecting a loan, arguably the most important factor is the interest rate. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan amount. Related Articles. Click here to post a comment. Should I Buy Ripple? The rise of new technologies often give rise to new business models. If privacy is important to you, there are several steps you can take to protect your identity when sending and receiving cryptocurrency.

Arrange a time to meet somewhere public. Finder, or the author, may have holdings in the cryptocurrencies discussed. A borrower enters relevant loan data into a smart contract. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. Check past issues. For instance, if a user is borrowing from a lender located in another country by keeping their Bitcoin as collateral, he or she will find it difficult to hold where to withdraw poloniex to how to transfer from bittrex to hardware wallet lender accountable in case the regulatory conditions of that country change for the worse. Once you have fulfilled both requirements, head over to Shapeshift. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. In short, borrowers will need to submit online credit checks and personal information just like any other online loan platform. Similarly, lenders can create their own loan offer, specifying the interest rate, accepted collateral and maximum loan amounts, which can then be quickly accepted by a borrower. You may also like. In conclusion, Lippiatt added:

Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of this. Do note, Changelly would require you to create an account using an email address. All collateral deposits are held in cold storage. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. Part of this is a result of the largely unregulated early days of cryptocurrency, which meant several unscrupulous organizations ended up scamming. The plugin acts as a link between the Ethereum network and the web browser. Their commercial loans are geared to companies that want to free up capital, expand their businesses, buy expensive equipment, and balance their portfolios. Consider your own circumstances, and obtain your own advice, before relying on this information. As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. Compare up to 4 providers Clear selection. Credit Card. In short, borrowers will need to submit online credit checks and personal information just like any other online loan platform.

Since Bitcoin loans are secured using cryptocurrency as collateral, Bitcoin companies are able to have much more relaxed requirements when it comes to loan approval. Once you have fulfilled both requirements, head over to Shapeshift. On the downside, EthLend, only deals with crypto-to-crypto borrowings, neglecting users interested in fiat. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. BlockFi promises that the team will review the application and get back to the applicant in one business day. According to Celsius whitepaper, it seeks to offer revolutionary financial tools that help network members in lending, borrowing and depositing different crypto assets. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Like other lending platforms, Celsius does not depend on credit scores. HODL Finance. BlockFi offers flexible repayments, a feature that makes it stand out in the market. Each vendor on the page has a review history which gives you a good idea of how trustworthy the transaction will be. Cryptocurrency exchanges and shifting services Relatively simple to use, competitive fees More and more exchanges require proof of ID, virtually impossible to buy crypto with fiat currency without providing proof of ID On the vast majority of cryptocurrency exchanges, using fiat currency to buy cryptocurrency without ID is impossible. On Thursday the fintech startup Fluidity will announce plans for the first ethereum-powered mortgages in California and New York, CoinDesk has learned. SALT Lending has a streamlined sign up process.

Subscribe to Blog via Email Enter your email address to erithium coin mining eth cpu mining to this blog and receive notifications of new posts by email. HODL Finance. The emergence of cryptocurrencies has led to a revolution in the financial sector. Shorter loans benefit from lower interest rates, starting at 7. Mining difficulty has increased significantly To compensate for increasing hardware speed and varying interest in running nodes over time, the difficulty of finding a valid hash is adjusted roughly every two weeks. Their commercial loans are geared to companies that want to free up capital, expand their businesses, buy expensive equipment, and balance their portfolios. Overall, the Nexo process reads like a rather quick and seamless process. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. Arrange a time to meet somewhere public. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Bitcoin loans have numerous advantages over traditional loans, however, there are some altcoin banks will use cheap cryptocurrency mining rig that must be acknowledged to make the most out of the experience, while avoiding bitcoin generation calculator xrp growth complications. Being a P2P lending platform, borrowers are able to post loan requests that can be filled at agreed terms with a lender. We use cookies to ensure that we give you the best experience on our website.

Just like a traditional bank, BlockFi has an eligibility criterion for all borrowers. The platform stands out for offering loans in 51 different fiat currencies. Like your credit card, your bank account is linked to your identity, so buying crypto via bank transfer or any other method linked to your account will always be traceable back to you. Tier 0 is. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Go to site View details. Expect delay plus the delay from any exchange services. We expect to see more similar blockchain projects considering that the cryptocurrency sector is on course for mass adoption. The democratizing access to loans means leveraging your cryptocurrencies without liquidation. Interest rates go from 12 to 14 percent APR, and there is an added fee of one to four percent of the loan value. On all loan requests, EthLend deducts a 0. Register an account on Changelly Meet Shapeshift: Compare all cryptocurrency exchanges and marketplaces.