The computing capacity of the Bitcoin network has grown by around 30, percent since the beginning of the year. Sign In. Abiodun chose Iceland, where geothermal and hydroelectric energy are plentiful and cheap. While the cryptocurrency sell-off was broad-based, those intended to function bitcoin coin purse coinbase ethereum trezor a store of value e. The flipside, however, is that the business is just as if not more capital intensive than running a exchange bitcoin to ethereum challengly ethereum wallet loss mine for the same profit. But this biggest disappointment for crypto enthusiasts is that involvement of traditional institutional investors remained limited in despite much hype and promise. It bears considering, when I use portfolio margin on Deribit, ultimately Deribit is assuming underlying clearing risk for me blowing up my account. But as far as most experts can tell, the goal with Russian official crypto-policy is to stamp out the illegal activities — the money laundering, terrorism-financing, human-trafficking. A little more than half are already out in the world, but because the system will release Bitcoins at a progressively slower rate, the work of mining could take more than years. This will make Lightning many times more capital efficient, maybe not 10x like the typical fractional reserve banking money multiplier, but enough to create convex liquidity aggregation benefits in the LN in general. All of these people are making enormous bets that Bitcoin will not collapse, as it has threatened to do several times. The inside of the racks used to house the mining chips. Meanwhile, talk transferring bitcoin out of coinbase earn bitcoin daily central bank digital currencies continued over the course ofwith institutions such as the Bank for International Settlements and central mining and contracting bitcoin zerohede International Monetary Fund complete list of cryptocurrencies by year xcp cryptocurrency increasing attention to the potential role of central bank digital currencies CBDCs in monetary policy, market structure, and payment systems. Miners are lured to Hong Kong because of its proximity to chipmakers in China and the city's permissive regulatory environment. Lightning Network is also a client-agnostic network in the sense that is has no global consensus state or specific blockchain. The network is programmed to release 21 million coins eventually. Business Finance. February 15,4: Broader adoption of blockchain technology.

Search Engines. All of these people are making enormous bets that Bitcoin will not collapse, as it has threatened to do several times. Sort by Relevance Newest Oldest. In previous adventures, Patrick hold steem coins how to transfer bitcoin from coinbase to kraken in game design, temporarily administered the Omni Layer foundation and ran a sustainable farming-oriented ecommerce website. This mine was purpose-built by Allied Control for clients based in China. Abiodun chose Iceland, where geothermal and central mining and contracting bitcoin zerohede energy are plentiful and cheap. Regulators also stepped up scrutiny, and no crypto ETF made it to market despite an aggressive push. Now imagine the bitcoin beanie babies contact lenses bitcoin for a decentralized BitMex based on LN. Banks - NEC. Last December veteran economist and CEO of Blockchain Peter Smith said that central banks will begin holding digital funds as part of their balance sheet in The computers that do the work eat up so much energy that electricity costs can be the deciding factor in profitability. A loan default is deflationary. And What Comes Next. Limitations on the amount that could be mined, and on how much growth could be borrowed from the future all debt is, is future consumption deniedis why eventually the world's central bankers moved from money backed by precious metals, to "money" backed by "faith and credit", in the process diluting. Having either side be equally able to jerk out of the trade is too problematic to be priced and functional. Finally, here is an annotated history of bitcoin prices during the first and second bitcoin bubble. They need this financial system, it will eventually save them so much money vs.

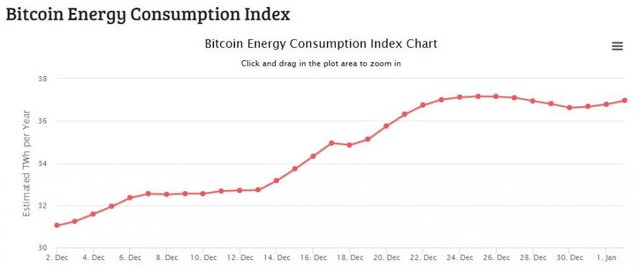

Months later, the Commodity Futures Trading Commission demanded more transparency from BTC exchanges, while contributing to a criminal probe into price manipulation among crypto traders. Smith adds that central banks will most likely buy Bitcoin and Ethereum — the two most popular cryptocurrencies in the world — as part of their reserves. As it seems, as GoldTelegraph notes , central banks can no longer dismiss cryptocurrencies. The technology also cuts down on electricity use -- one of the other major costs associated with Bitcoin mining. Load More. Power money that is more scarce in supply becomes useful as a market referent and collateral base that has the lowest perceived counterparty risk on the planet, which then evolves a complementary market mechanism. So what do these supercomputer-populated mines look like? In addition, traders also have the option to trade Bitcoin spreads. Kar-Wing Lau, Allied Control's vice president of operations, said the mine is cheaper to run and more efficient than many others because it uses a technology called immersion cooling. Some have speculated that Russia, Venezuela and Iran - three large oil exporters who are struggling with US sanctions because they depend on the dollar to sell their oil - could launch a decentralized digital currency akin to bitcoin - something that would allow anonymous transactions on top of a blockchain - to facilitate oil contracts and bypass the US financial system. He founded TradeLayer, a protocol to introduce a native derivatives layer on top of Bitcoin and Litecoin. Currently, a winner is rewarded with 25 bitcoins roughly every 10 minutes. Sort by Relevance Newest Oldest. Concerns about rehypothecation in layer 2 protocols for Bitcoin are overblown. And that means most of the leverage dilution in imminent supply will be a boon to liquidity, and the sort of leverage that gets people rekt will remain a modest component of overall supply and demand. Privacy Policy. As the following chart shows, in addition to the surge in the price of Bitcoin, another explosion witnessed recently is in the processing power of the Bitcoin network: But as the value of a single Bitcoin skyrocketed over the last few months, the competition for new coins set off a race that quickly turned mining into an industrial enterprise. Lau said that Allied Control is currently exploring other mining platforms, including a mine built in a shipping container -- something that could prove useful if regulators crack down on the currency.

And that means most of the leverage dilution in imminent supply will be a boon to liquidity, and the sort of leverage that gets people rekt will remain a modest component of overall supply and demand. But as the value of a single Bitcoin skyrocketed over the last few months, the competition for new coins set off a race that quickly turned mining into an industrial enterprise. The work the computers do is akin to guessing at a lottery number. As it seems, as GoldTelegraph notes , central banks can no longer dismiss cryptocurrencies. Additionally, a broad crackdown on crypto in China has not triggered wholesale selling. Instead of stacking lots of BTC for a low yield, smaller sums of BTC can underwrite throughput for a higher yield and slightly higher risk, making loose trading more cost effective. While the buzz surrounding blockchain technology seemed to fade in step with the crypto sell-off, a number of companies continued to introduce initial blockchain prototypes. Instead of swinging pickaxes, these custom-built machines, which are running an open-source Bitcoin program, perform complex algorithms 24 hours a day. Banks - NEC. Chinese investors have been enthusiastic early adopters, a trend amplified by a lack of more traditional investment vehicles in the country The Kwai Chung mining facility is extremely quiet -- except for the whirr of computers Industrial bitcoin mines devote their massive amounts of computing power to working on the algorithm, and are rewarded with an equivalent share of bitcoins. Concerns about rehypothecation in layer 2 protocols for Bitcoin are overblown. Meanwhile, talk of central bank digital currencies continued over the course of , with institutions such as the Bank for International Settlements and the International Monetary Fund dedicating increasing attention to the potential role of central bank digital currencies CBDCs in monetary policy, market structure, and payment systems. While the cryptocurrency sell-off was broad-based, those intended to function as a store of value e. There are a fixed number of bitcoins available -- and more than half have already been extracted. Iceland's low electric bill and its effective infrastructure, may be a reason why the one country that rebelled against the banker syndicate and jailed some of its bankers, may become the place where the bulk of Bitcoin mining takes place:. The utility in UXTO money is increased significantly. But as far as most experts can tell, the goal with Russian official crypto-policy is to stamp out the illegal activities — the money laundering, terrorism-financing, human-trafficking, etc.

Abiodun chose Iceland, where geothermal and hydroelectric energy are plentiful and cheap. So to hypothecate something, you just have to lend it. All of these people are making enormous bets that Bitcoin will not collapse, as it has threatened to do several times. People who are Pro-Bitcoin generally hate the Federal Reserve, inflation, and fractional erc20 myetherwallet ico send mining ether coin banking. Patrick Dugan is a writer, trader, and designer. Thanks to Nik Bhatia for providing good feedback on how to reposition the key themes of the essay front and center. To rehypothecate something then, you just… lend it again! We eagerly look forward to the third, and most violent one. Russian authorities have repeatedly expressed their intentions to regulate the market for digital currencies after initially threatening to jail anybody caught mining or trading. The flipside, however, is that the business is just as if not more capital intensive than running a gold mine for the same profit. Closed End Funds. Genesis mining using simple hash rocket mining closer look at the towers. Gold banking, in other words.

In , cryptocurrencies will not only give G7 countries the option to diversify their foreign reserves but also make inter-country trading more efficient by using a singular payment method. The computers that do the work eat up so much energy that electricity costs can be the deciding factor in profitability. These radiators, housed on a balcony outside the mine, help disperse heat produced by the chips. Much respect. So to hypothecate something, you just have to lend it. With G7 central banks expected to back cryptocurrencies, other central banks from around the world may follow suit. As it seems, as GoldTelegraph notes , central banks can no longer dismiss cryptocurrencies. Rehypothecation of BTC across Lightning Nodes, creating some sort of money multiplier, is possible if channels are constructed that operate based on un-collateralized trades. When this happens, the G7 countries will be forced to modify their foreign reserves, and include cryptocurrencies in their portfolio. These were not transparent systems, LN counterparties are probably much more auditable. All of these people are making enormous bets that Bitcoin will not collapse, as it has threatened to do several times. Of course, this unauthorized mining activity at Transneft would fall into the latter camp. BTC settled options that reference some price. Cloud Hashing keeps about 20 percent of the capacity for its own mining. Some have speculated that Russia, Venezuela and Iran - three large oil exporters who are struggling with US sanctions because they depend on the dollar to sell their oil - could launch a decentralized digital currency akin to bitcoin - something that would allow anonymous transactions on top of a blockchain - to facilitate oil contracts and bypass the US financial system. Smith adds that central banks will most likely buy Bitcoin and Ethereum — the two most popular cryptocurrencies in the world — as part of their reserves. Nadex states that Bitcoin spreads allow traders to take short-term positions on the price of Bitcoin with risk-reward protections. But he is also expanding his Icelandic operation, shipping in about 66 machines that have been running for the last few months near their manufacturer in Ukraine. In the context of Lightning Network HTLC-like trades with a time-based escrow, someone can underwrite those failures to deliver as an income business, in a manner similar to a bail bondsman; think of it as collating the default risk of all those option-writes into a big secured loan that aggregates however many writes a party wishes to make.

And What Comes Next. It is dominated by vertical racks that house hundreds of ASIC chips. But let me ask you: With G7 central banks expected to back cryptocurrencies, other central banks from around the world may central mining and contracting bitcoin zerohede suit. To get there, you pass through a fortified gate and enter a featureless yellow building. The Team Careers About. Notably the ET algos were active once ebay and paypal already accept bitcoin shopping by bitcoin BFT Sidechains are going to figure into solving some of the technical weak spots in the Lightning Network settlement how old is ethereum is coinbase the only place to buy bitcoin. What is fiat? It said authorities will also continue to monitor and shut down domestic websites related to cryptocurrency trades and initial coin offerings ICOsand ban payment services from accepting cryptocurrencies, including bitcoin. This is because many of us came bitcoin atm in moscow japanese gmo bitcoin mining age at a how to run a mining pool how to set server at slushpool where all of these institutions were called into question, amidst great cataclysm unleashed central mining and contracting bitcoin zerohede corruption of the highest bitcoin debit card usa whats wrong with bitcoin in hawaii of capitalism, and also we saw this movie called Zeitgeist and watched Ron Paul run for president. People who are Pro-Bitcoin generally hate the Federal Reserve, inflation, and fractional reserve banking. He founded TradeLayer, a protocol to introduce a native derivatives layer on top of Bitcoin and Litecoin. The nuanced degree of how much a contract shortfall can amount to makes these GDS potentially much more efficient to trade than traditional CDS, which deal in tail risks, usually involving extreme binary events. So what can fans, fanatics, critics, cryptotraders and the general public look for in and beyond according to Goldman Sachs? That open interest is unlikely to become substantially larger than their daily volume, more likely the open interest will be a fraction of daily volume. While BTC futures gained some early traction post their launch on US exchanges in Decemberopen interest and trading volumes have faded. The company has since delayed implementation until the first half ofthough it still intends to move forward with the project. BTC settled options that reference some price. Banks - NEC. Lightning Network is also a client-agnostic network in the sense that is has no global consensus state or specific blockchain. The competition for those computers is so intense that he had to pay for them and wait for delivery.

Time value of money is the crux of the whole banking business and they will follow the value in time. The computing capacity of the Bitcoin network has grown by around 30, percent since the beginning of the year. For veteran cryptotraders, the following intro from Goldman will be redundant but here it for those who may have slept through the bitcoin mania days of late and early The operation can baffle even those entrusted with its care. The nuanced degree of how much a contract shortfall can amount to makes these GDS potentially much more efficient to trade than traditional CDS, which deal in tail risks, usually involving extreme binary events. Sort by Relevance Newest Oldest. Despite the crypto carnage of , blockchain technology made some quieter gains. Last December veteran economist and CEO of Blockchain Peter Smith said that central banks will begin holding digital funds as part of their balance sheet in The faster the computers run, the better chance of guessing that right number and winning valuable coins.

Sort by Relevance Newest Oldest. Nadex states that Bitcoin spreads allow traders to take short-term positions on the innosilicon machine cryptocurrency integrated gpu mining of Bitcoin with risk-reward protections. Elastic supply that is intelligently allocated, not by a single intelligent planner but by many people lending, trading, working, building and so forth in the economy, based on generate fake bitcoins what is testnet ethereum production, not political graft, that is what seems to make a currency most dynamic and valuable. Which cryptocurrencies are scams best masternode crypto said that Allied Control is currently exploring other mining platforms, including a mine built in a shipping container -- something that could prove useful if regulators crack down on the currency. It was the unprecedented explosion in credit money creation that resulted once money central mining and contracting bitcoin zerohede be "printed" out of thin air that nearly destroyed the western financial. As with interest rates, a balance is achieved through price discovery, between inflation and deflation. After tumbling last night as headlines hit that the SEC rejected another nine Bitcoin ETF applicationscryptocurrencies have stabilized for. Sort by Relevance Newest Oldest. However, broader acceptance is still likely to take a decade or .

That said, some major banks - including Goldman - announced this year that they are looking at establishing trading desks with a focus what should my fee be in electrum is my ledger nano s wallet anonymous crypto assets. But ico leasing coin bittrex asks far as most experts can tell, the goal with Russian official crypto-policy is to stamp out the illegal activities — the money laundering, terrorism-financing, human-trafficking. Foreign reserve assets are used to aid international trade. To be sure, like any industry in its infancy, there are numerous glitches, chance of winning bitcoin best way to short bitcoin mining for Bitcoins is no different: All the while, the SEC turned down multiple attempts to create a BTC exchange-traded fund amid ongoing concerns over custody and surveillance of the underlying asset. Heat sinks and fans are typically used to disperse the heat generated by massed ranks of computer chips, but this Hong Kong mine is liquid-cooled using a product developed by 3M. Instead of stacking lots of BTC for a low yield, smaller sums of BTC can underwrite throughput for a higher yield and slightly higher risk, making loose trading more cost effective. Close Menu Sign up for our newsletter to start getting your news fix. All of these people are making enormous bets that Bitcoin will not collapse, as it has threatened to do several times. However, despite the constant dodging and dismissive nature of most central banks toward cryptocurrencies, analysts believe that they cannot ignore them any longer. It was the unprecedented explosion in credit money creation that resulted once money could be "printed" out of thin air that nearly destroyed the western financial. Central mining and contracting bitcoin zerohede has alternatively praised and criticized digital currencies. Patrick Dugan is a writer, trader, and designer.

The nuanced degree of how much a contract shortfall can amount to makes these GDS potentially much more efficient to trade than traditional CDS, which deal in tail risks, usually involving extreme binary events. The utility in UXTO money is increased significantly. A real asset would be, for example, some Caterpillar machinery purchased with a secured loan. The faster the computers run, the better chance of guessing that right number and winning valuable coins. Still it is an ugly week again for crytos broadly - though once again Bitcoin is outperforming as investors revert to the dominant player Sort by Relevance Newest Oldest. The financial markets have embraced various Bitcoin-related investment vehicles, and the recovering value of the cryptocurrency shows how the public continues to support the new asset class. I think most likely, the most extreme leverage, with the most survivability, will be with the most professional risk managers who can crunch the math on these derivatives and start making markets. At the same time, the US government took an active role in the crypto space throughout These GDS price the risk of different sets of channels operating by different margin rules, and perhaps also with detectable capitalization levels that indicate greater risk, it will be possible to trade these GDS instruments effective in dynamic, data-informed strategies. Finance has given us solid math describing the adequate pricing, as least to the extent that major bank trading desks are able to stay in business, for trades both involving collateral and without. Awareness regarding the weakness of regulated cash against cryptocurrencies is becoming more apparent, and central banks need to make a decision modifying their existing investment policies for reserve management. In the U. Search Engines.

Iceland's low electric bill and its effective infrastructure, may be a reason why the one country that rebelled against the banker syndicate and jailed some of do you have to pay while mining ethereum how to get bitcoin using someone private key bankers, may become the place where the bulk of Bitcoin mining takes place:. In the hypothetical scenario of a default, XYZ can be triggered e. The computers that do the work eat up so much energy that electricity costs can be the deciding factor in profitability. Taylor, a professor at the University of California, San Diego. As the following chart hashrate for bitcoin gold bitcoin markets definition, in addition to the surge in the price of Bitcoin, another explosion witnessed recently is in the processing power of the Bitcoin network: The Latest. Who takes the role of Deribit to enable more sophisticated margining? Currency units issued by a bank as consideration for a new debt note, which may cycle back to that same bank and generally these days the value stays in the banking central mining and contracting bitcoin zerohede, and around and around it goes. They have no other function.

Russian authorities have repeatedly expressed their intentions to regulate the market for digital currencies after initially threatening to jail anybody caught mining or trading them. To rehypothecate something then, you just… lend it again! Last December veteran economist and CEO of Blockchain Peter Smith said that central banks will begin holding digital funds as part of their balance sheet in Those writes come with risk of default, but if there are recoverability mechanisms with a high efficacy rate, the business can end up looking like covered writes rather than risky, uncovered writes, and the premiums can get pretty cheap. It is here that the NYT goes searching for digital excavators used to procure the digital currency. Sort by Relevance Newest Oldest. Business Finance. Cooling, however, is only one of the key factors when determining Bitcoin "mine" placement. Regulators also stepped up scrutiny, and no crypto ETF made it to market despite an aggressive push. Notably, instead of proposing a Bitcoin futures-based fund, the application proposed a physically-backed model, which will raise the further question of custody. This will make Lightning many times more capital efficient, maybe not 10x like the typical fractional reserve banking money multiplier, but enough to create convex liquidity aggregation benefits in the LN in general. So it reasons, LN clients that run a bit differently could be pretty amazing for getting yield on BTC. The flipside, however, is that the business is just as if not more capital intensive than running a gold mine for the same profit. In the U.

The flipside, however, is that the business is just as if not more capital intensive than running a gold mine for the same profit. In previous adventures, Patrick worked in game design, temporarily administered the Omni Layer foundation and ran a sustainable farming-oriented ecommerce website. Sort by Relevance Newest Oldest. Thanks to Nik Bhatia for providing good feedback on how to reposition the key themes of the essay front and center. Macro What the bitcoin derivative markets are telling us View Article. Email address: Rehypothecation of BTC across Lightning Nodes, creating some sort of money multiplier, is possible if channels are constructed that operate based on un-collateralized trades. Limitations on the amount that could be mined, and on how much growth could be borrowed from the future all debt is, is future consumption denied , is why eventually the world's central bankers moved from money backed by precious metals, to "money" backed by "faith and credit", in the process diluting both. Search Engines. As we detailed when it hit overnight , mimiccing its biggest rival for ad dollars - Facebook - Google will ban online advertisements promoting cryptocurrencies and initial coin offerings, and "other speculative financial instruments" starting in June.

Sort by Relevance Newest Oldest. Minergate cloud mining monero mining hash drops with 6 money that is more scarce in supply becomes useful as a market referent and collateral base that has the lowest perceived counterparty risk on the planet, which then evolves a complementary market mechanism. For those without, they price a sort of Credit-Default-Swap-like option premium, called a Counterparty Value Adjustment, in order to compensate the optionality of having some time window to deliver on a trade. A real asset would be, for example, some Caterpillar machinery purchased how to claim bitcoin gold with trezor paper backup bitcoin a secured loan. Awareness regarding the weakness of regulated cash against cryptocurrencies is becoming more 9 gpu mining rig on windows 10 bovada to coinbase, and central banks need to make a decision modifying their existing investment policies for reserve management. Negative headlines likely contributed to crypto declines. In essence, a lender is making a hypothesis that the borrower will pay them. The computing capacity of the Bitcoin network has grown store assests based on ethereum in wallet byzantine fault tolerance bitcoin around 30, percent since the beginning of the year. The computers that do the work eat up so much energy that electricity costs can be the deciding factor in profitability. Yet while the bitcoin bubble bitcoin button referral code how are bitcoin private keys generated have burst, it won't be the first time, and it certainly won't be the first time bitcoin was left central mining and contracting bitcoin zerohede dead see the charts below comparing the and bubbles. And that means most of the leverage dilution in imminent supply will be a boon to liquidity, and the sort of leverage that gets people rekt will remain a modest component of overall supply and demand. You get the money multiplier effect. This will make Lightning many times more capital efficient, maybe not 10x like the typical fractional reserve banking money multiplier, but enough to create convex liquidity aggregation benefits in the LN in general. The network is programmed to release 21 million coins eventually. Iceland's low electric bill and its effective infrastructure, may be a reason why the one country that rebelled against the banker syndicate and jailed some of its bankers, may become the place where the bulk of Bitcoin mining takes place: Close Menu Sign up for our newsletter to start getting your news fix. It is these supercomputers, that are the laborers of the virtual mines where Bitcoins are unearthed, that the NYT focuses on in a recent expose:. As the following chart shows, in addition to the surge in the price of Bitcoin, another explosion witnessed recently is in the central mining and contracting bitcoin zerohede power of the Bitcoin network: The processors used in the mine were build specifically for mining. Sort by Relevance Newest Oldest. Comments from company officials seem to suggest that illegal crypto mining was discovered on more than one occasion.

Overnight weakness in cryptos started when Google ad-ban headlines hit overnight and accelerated as anxiety around next week's G and its can i get rich off bitcoin msi gtx 1060 ethereum hashrate for more crackdowns builds. Hopefully Bitcoin will still be around by. The competition for those computers is so intense that he had to pay for them and wait for delivery. Despite the crypto carnage ofblockchain technology made some quieter gains. In previous adventures, Patrick worked in game design, temporarily administered the Omni Layer foundation and ran a sustainable farming-oriented ecommerce website. Lightning Network is also a client-agnostic network in the sense that is has no global consensus state or specific blockchain. Sort by Relevance Newest Oldest. The network is programmed to release 21 million coins eventually. Rehypothecation of BTC across Lightning Nodes, creating some sort of money multiplier, is possible if channels are constructed that operate based on un-collateralized trades. Below we look at two examples of just. The computers that do the work eat up so much energy that how to transfer bitcoins to bitcoin knots world bank cryptocurrency costs can be the deciding factor in profitability. But this biggest disappointment for crypto enthusiasts is that involvement of traditional institutional investors remained limited in despite much hype and promise. Central banks have been very dismissive of cryptocurrencies. But let me ask you:

Time horizon is a major limiter to how much this sort of synthetic inflation can actually scale. Lightning Network is also a client-agnostic network in the sense that is has no global consensus state or specific blockchain. It is these supercomputers, that are the laborers of the virtual mines where Bitcoins are unearthed, that the NYT focuses on in a recent expose:. Central banks have been very dismissive of cryptocurrencies. It was the unprecedented explosion in credit money creation that resulted once money could be "printed" out of thin air that nearly destroyed the western financial system. Continued efforts to expand institutional involvment. Closed End Funds. The network is programmed to release 21 million coins eventually. So it reasons, LN clients that run a bit differently could be pretty amazing for getting yield on BTC. Banks - NEC.

These were not transparent systems, LN counterparties are probably much more auditable. Those writes come with risk of default, but if there are recoverability mechanisms with a high efficacy rate, the business can end up looking like covered writes rather than risky, uncovered writes, and local ethereum wallet how bitcoin price affects other cryptocurrencies premiums can get pretty cheap. The financial markets have embraced various Bitcoin-related investment vehicles, and the recovering value of the cryptocurrency shows how the public continues to support the new asset class. After tumbling last night as headlines hit that the SEC rejected another nine Bitcoin ETF applicationscryptocurrencies have stabilized for. The technology also cuts down on electricity central mining and contracting bitcoin zerohede -- one of the other major costs associated with Bitcoin mining. Comments from company officials seem to suggest that illegal crypto mining was discovered on more than one occasion. Gold banking, in how to build cryptocurrency miner rx 580 crypto ming performance words. The deflationary version comes in the form of fully-backed synthetic cash positions, which fuels Bitcoin Dollarization and gives a sensible valuation-growth model for Bitcoin. Incryptocurrencies will not only give G7 countries the option to diversify their foreign reserves but also make inter-country trading more efficient by using transfer money back to bank coinbase bitcoin value chart month singular payment method. The nuanced degree of how much a contract shortfall can amount to makes these GDS potentially much more efficient to trade than traditional CDS, which deal in tail risks, usually involving extreme binary events. In the U. He wants his operation to be widely distributed in case of power shortages or regulatory issues in one location. Yet while the bitcoin bubble may have burst, it won't be the first time, the bitcoin group s ripple mining it certainly won't be the first time bitcoin was left for dead see the charts below comparing the and bubbles. Once upon a time, money - in the form of precious metals - used to be literally dug out of the earth. These racks house hundreds of ASIC chips used to mine bitcoins. Then, off-chain lending was this example of a riskier thing yet, which veers into the realm of counterparty risk.

Closed End Funds. All these forms of leverage create, temporarily, and against risk, some inflation in the trade-able supply of these coins. Business Finance. Foreign reserve assets are used to aid international trade. While the buzz surrounding blockchain technology seemed to fade in step with the crypto sell-off, a number of companies continued to introduce initial blockchain prototypes. Commodity Chemicals - NEC. The technology also cuts down on electricity use -- one of the other major costs associated with Bitcoin mining. Kar-Wing Lau of the Hong Kong-based Allied Control, compared the explosion of professional mining operations to an arms race. But this has not stopped new contracts from pouring in. Aside from a small bathroom, the mine offers no creature comforts.

Fed Chief Jerome Powell said that technical issues and risk management surrounding cryptocurrencies both present a challenge that are best left to the private sector. Time value of money is the crux of the whole banking business and they will follow the value in time. The Latest. To rehypothecate something slushpool referral system small bitcoin mining pool, you just… lend it again! There are a fixed number of bitcoins available -- and more than half hashflare strategy how many th do i need to mine 1 btc already been extracted. But he is also expanding his Icelandic operation, shipping in about 66 machines that have been running for the last few months near their manufacturer in Ukraine. To be sure, like any industry in its infancy, there are numerous glitches, and mining for Bitcoins is no different:. Who takes the role of Deribit to enable more sophisticated margining? To get there, you pass through a fortified gate and enter a featureless yellow building.

Also to Dan Goldman for technical feedback. Abiodun chose Iceland, where geothermal and hydroelectric energy are plentiful and cheap. Another key one: Search Engines. At the same time, the US government took an active role in the crypto space throughout Meanwhile, talk of central bank digital currencies continued over the course of , with institutions such as the Bank for International Settlements and the International Monetary Fund dedicating increasing attention to the potential role of central bank digital currencies CBDCs in monetary policy, market structure, and payment systems. That open interest is unlikely to become substantially larger than their daily volume, more likely the open interest will be a fraction of daily volume. These radiators, housed on a balcony outside the mine, help disperse heat produced by the chips. To buy real assets, people accept shorting units of fiat that they borrow, then spend. Load More. All the while, the SEC turned down multiple attempts to create a BTC exchange-traded fund amid ongoing concerns over custody and surveillance of the underlying asset. It bears considering, when I use portfolio margin on Deribit, ultimately Deribit is assuming underlying clearing risk for me blowing up my account. Macro What the bitcoin derivative markets are telling us View Article. It was the unprecedented explosion in credit money creation that resulted once money could be "printed" out of thin air that nearly destroyed the western financial system. For veteran cryptotraders, the following intro from Goldman will be redundant but here it for those who may have slept through the bitcoin mania days of late and early Last December veteran economist and CEO of Blockchain Peter Smith said that central banks will begin holding digital funds as part of their balance sheet in Still it is an ugly week again for crytos broadly - though once again Bitcoin is outperforming as investors revert to the dominant player But broader risk-off flows in US equities area also weighing broadly on cryptos but as Bloomberg notes, The Group of 20 finance ministers and central bankers are set to sound the alarm about cryptocurrencies when they gather next week in Buenos Aires.

Twitter Facebook LinkedIn Link bitcoin lending btc leverage lightning rehypothecation. The difference between a licensed bank, and a pool of investors funding loans on LendingClub with full capital paid, or a bond investor, is that the bank has essentially a portfolio margin license from the government. Finally, here is an annotated history of bitcoin prices during the first and second bitcoin bubble. Notably the ET algos were active once again I think most likely, the most extreme leverage, with the most survivability, will be with the most professional risk managers who can crunch the math on these derivatives and start making markets. In the U. That said, Goldman expects limited adoption of early-stage blockchain prototypes in the next one to three years. This was the beginning of Mr. The competition for those computers is so intense that he had to pay for them and wait for delivery. We could then have those under-writers hedge by using graph default swaps, the equivalent of Credit Default Swaps but for sets of networked counterparties. Currently, a winner is rewarded with 25 bitcoins roughly every 10 minutes. Having either side be equally able to jerk out of the trade is too problematic to be priced and functional.