Any consumer or merchant can trade in and out of Bitcoin and other currencies any time they want. Actually, this is not at all the case. Future email systems and social networks could refuse to accept incoming messages unless they were accompanied with tiny amounts of Bitcoin — tiny enough to not matter to the sender, but large enough to deter spammers, who today can send uncounted billions of spam messages for free with impunity. He may be outside the main hub of crypto elite, but something seems to suggest that Chaum has chosen it that way; at least in. The inside story of Coinbase internal power struggle Op-ed: This proved to be a very difficult feat. During the next two years, I started thinking through scenarios of monetizing equity mutual funds and real estate and how ideas like e-gold could be transformed into digital bearer instruments backed by gold, not just a ledger-based transfer. Close Menu Search Search. The main features of the different types of money. USDT Tether. They can try to steal money bitcoin financial news update bitcoin digital bearer instrument from poorly-secured merchant computer systems. Critics when will ethereum price go up how do you buy ethereum on gdax Bitcoin point to limited usage by ordinary consumers and merchants, but that same criticism was leveled against PCs and the Internet at the same stage. Bitcoin can allow users to efficiently transmit money over the internet, without using deposits at financial institutions. Otherwise, this network effect will carry Bitcoin to dominance. Electronic transfers Using the banking system, it is possible to send money effectively over the internet or by phone, across the world at low cost. ETH Ethereum. So what is that magical permissible level of adoption where going beyond that point jeopardizes central banking and monetary policy? The above dynamic of credit expansion and fractional reserve banking, is not understood by. Building the bitcoin infrastructure around the world is important, but within certain jurisdictions it can also be a frustrating contradiction. In traditional banking models there are only two fundamental choices: The capital ratio, is a ratio between the equity of bitcoin deposit bonus new block found solo bitcoin picture bank and the total assets or more precisely risk weighted assets. Privacy Policy. Competing financial institutions could use bitcoin mining crisis pc parts how much does 1 bitcoin cost common database to keep track of the execution, clearing and settlement of transactions without the need to involve any central database or management .

Bitcoin shares many of the advantages of physical cash over electronic bitcoin cash mining profitability sell bitcoin denver deposits. Individuals with these fringe political and economic views, may think this is some kind of grand conspiracy by powerful elite bankers, to ensure their control over the economy. The success of an investment depends less on the execution of a stellar management team and more on the degree of regulatory latitude. The Elixxir blockchain genesis mining review ethereum hash mining software yet to launch, with no fixed timeline in sight beyond an upcoming BetaNet. Other developers are coding financial instruments that can be pre-programed to carry out corporate actions and business logic. Mostly, he criticizes Silicon Valley for its self-indulgent hyper-capitalism that lacks meaningful solutions to real-world problems. The unique properties of Bitcoin. Even Netflix, a completely virtual service, is only available in about 40 countries. He holds that crown tightly, with DigiCash having made him a temporary icon.

It also has a deadline of October to clarify how its standards apply to crypto-assets specifically. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Unlike Bitcoin, cash is widely used as a vehicle for money laundering, given its anonymity as a bearer negotiable instrument with no audit trail, per Europol and the Australian Black Economy Taskforce. This is the form of fraud that motivates so many criminals to put so much work into stealing personal customer information and credit card numbers. Furthermore, if a predicate offense like narcotrafficking generates cash, the laundering process is more likely to involve cash. Anything digital could be copied with the click of a button. Twitter Facebook LinkedIn Link decentralized-finance defi genesis lending regulation week-in-review canadian-revenue-agency censorship-resistance dharma irs long-blockchain taxes. He may be outside the main hub of crypto elite, but something seems to suggest that Chaum has chosen it that way; at least in part. For example the ability to use money using your mobile phone or on your computer Precise amounts can be sent so there is no issue with receiving change Handling cash is often a difficult and cumbersome process. Or as Satoshi Nakamoto described it: The new SSL encryption in Netscape browsers relied on these digital certificates for authenticating and securing web servers. This is because the advantages of keeping money on deposit at a bank are not always as pronounced in Bitcoin, compared to the alternatives.

Traditional banks offer the ability to track, control and monitor all transactions, which can help prevent fraud. Ravi Nayyar is completing an Honors thesis at the University of Sydney about anti-money laundering regulation of cryptocurrencies. Furthermore, if a predicate offense like narcotrafficking generates cash, the laundering process is more likely to involve cash. Finally, a fourth interesting use case is public payments. We merely provide opinions and education so that you can Do Your Own Research. This idea first came to my attention in a news article a few months ago. Electronic transfers Using the banking system, it is possible to send money effectively over the internet or by phone, across the world at low cost. This is because the advantages of keeping money on deposit at a bank are not always as pronounced in Bitcoin, compared to the alternatives. Loan asset: Like any bearer asset, cryptocurrencies can be lost or stolen. If you get on the wrong side of your bank, or someone with influence over your bank, you risk having your assets frozen. Competing financial institutions could use this common database to keep track of the execution, clearing and settlement of transactions without the need to involve any central database or management system. The more people who use Bitcoin, the more valuable Bitcoin is for everyone who uses it, and the higher the incentive for the next user to start using the technology. The fundamental cause of the credit expansionary dynamic The above dynamic of credit expansion and fractional reserve banking, is not understood by many. All over Silicon Valley and around the world, many thousands of programmers are using Bitcoin as a building block for a kaleidoscope of new product and service ideas that were not possible before. Ethereum Review.

Well, maybe criminals are still happy: The simple table below illustrates this key unique feature of Bitcoin and blockchain based tokens. Understanding the dynamics of these characteristics, can be useful in evaluating the potential economic significance of Bitcoin, should the ecosystem grow. Bitcoin, as a global payment system anyone can use from anywhere at any time, can be a powerful catalyst to extend the benefits of the modern economic system to virtually everyone forum how to add credit card to coinbase ethereum casperr ethereum the planet. Money on deposit at a financial institution This is a binary choice with no middle ground options, forcing consumers to make a difficult choice with no compromise option available. See next articles. Therefore Bitcoin can be thought of as a new hybrid form of money, with some of the advantages of physical cash, but also some of the advantages of bank deposits. Nasdaq, for example, was one of the first to build bitcoin financial news update bitcoin digital bearer instrument platform enabling private companies to issue and trade shares using a blockchain. Banks therefore do not need to worry about keeping large quantities of physical cash in reserves. In short, the banks will be able to formalize and secure digital relationships between themselves in ways they could not. Load More. Political idealists project visions of liberation and revolution onto it; establishment elites heap contempt and scorn on it. We explain the implications this could have on the ability of banks to engage in credit expansion. In latefive years ago, a developer named Satoshi Nakamoto devised a protocol which distributed trust across a decentralized peer-to-peer ledger and eliminated confiscation risk by replacing physical assets with a mathematical proof of work. Bank deposits are treated this way for perfectly reasonable and logical reasons, in fact bank deposits have some significant advantages over physical cash. We merely provide opinions and education so that you can Do Your Own Research. Gold bars can be permanently lost at sea, and duffle bags full of cash can be robbed at gunpoint. We do not offer Bitcoin or crypto tips, strategies or trading models for you to copy. Personal computers inthe Internet inand — Msi r370 ethereum classic mining free bitcoin directly to wallet believe — Bitcoin in

Bitcoin Protocol via Shutterstock. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. The success of an investment depends less on the execution of a stellar management team and more on the degree of regulatory latitude. With this in mind, bitcoin developers have pioneered coloured coins that can act as stock in a company. Your email address will not be published. Bitcoin which country currency buy ethereum without ssn the other hand, technologists — nerds — are transfixed by it. Large physical cash balances at home could be vulnerable to theft or damage Physical cash cannot be insured and storage costs can be expensive. Join The Block Genesis Now. This is the form of fraud that motivates so waves coffee bitcoin faq bitcoin wallet criminals to put so much work into stealing personal customer information and credit card numbers.

Cryptocurrencies are only as censorship-resistant as their owners by Matteo Leibowitz March 11, , 8: We look at common misconceptions with respect to how banks make loans and the implications this has on the ability of banks to expand the level of credit in the economy. While regulators debate the pros and cons of bitcoins, this volatile digital currency inspires the question: Sign In. I am pro venture capital. Using a banking system to manage your money, can result in a convenient set of tools. To some extent, the dynamic described above allows banks to create new loans and expand the level of credit in the economy, almost at will, causing inflation. The Bitcoin currency had to be worth something before it could bear any amount of real-world payment volume. But bitcoin did something new: Of all of those choices, handing 2. Regulatory reporting and compliance Blockchains can serve as a fully transparent and accessible system of record for regulators. For example the ability to use money using your mobile phone or on your computer. Video Bitcoin Believers While regulators debate the pros and cons of bitcoins, this volatile digital currency inspires the question: Ray Dalio, the founder of Bridgewater Associates a leading investment firm , appears to agree that the credit cycle is a major driver of swings in economic growth, at least in the short term, as his video below explains:. ADA Cardano. Mostly, he criticizes Silicon Valley for its self-indulgent hyper-capitalism that lacks meaningful solutions to real-world problems. Finally, a fourth interesting use case is public payments. For example, perhaps the Rothschild family, JP Morgan, Goldman Sachs, the Bilderberg Group, the Federal Reserve or some other powerful secretive entity deliberately structured the financial system this way, so that they could gain some nefarious unfair advantage or influence?

Close Menu Sign up for our newsletter to start getting your news fix. The seizure of AlphaBay was especially significant in light of its being the largest illicit darknet marketplace at the time, per Europol. Physical cash vs bank deposits compared to Bitcoin vs Bitcoin deposits Factor Physical cash compared to deposits Bitcoin compared to Bitcoin deposits 1. Think about digital signatures, digital contracts, digital keys to physical locks, or to online lockersdigital ownership of physical assets such as cars and houses, digital stocks and bonds … and digital money. How Risky Are Cryptocurrencies? Can Governments Hoard and Destroy Bitcoin? The Team Careers About. For example the ability to use money using your mobile phone or on your computer Precise amounts can be sent so there is no issue with receiving change. We then consider why Bitcoin might have some unique how to store bitcoin cash ethereum blockchain download of characteristics, compared to traditional forms of money, namely the ability to transact electronically and avoid a third party financial intermediary, thereby avoiding the need for bank deposits, bitcoin financial news update bitcoin digital bearer instrument fuel the credit cycle. So you can specify an arbitrarily small amount of money, like a thousandth of a penny, and send it to anyone in the world for free or how hard is mining on gpu how hot too hot gpu mining. Enter The Block Genesis. Behind the scenes of a Crypto Company Ep There have also been numerous shutdowns of illicit darknet marketplaces whose economies were fuelled by crypto, including Silk RoadAlphaBay and Hansa. The credit cycle To some extent, the dynamic described above allows banks to create new loans and expand the level of credit in the economy, almost at will, causing inflation.

For starters, most money laundering does not occur through crypto, but cash. Bitcoin can allow users to efficiently transmit money over the internet, without using deposits at financial institutions. BTC Bitcoin. Banks therefore do not need to worry about keeping large quantities of physical cash in reserves. We analyse the inherent properties of money which ensure that this is the case. Of course, financial institutions use computers. Bitcoin can potentially allow a high level of security, without putting the funds on deposit at a bank For example Bitcoin can be concealed or encrypted. Think about the implications for protest movements. A quick look at the music industry and album sales tells this story convincingly. But the digital revolution has not yet revolutionized cross-border transactions. This is because the advantages of keeping money on deposit at a bank are not always as pronounced in Bitcoin, compared to the alternatives. Law enforcement's ability to effectively map out crypto transactions and use that financial intelligence was especially evident in June when the Spanish Guardia Civil and the Austrian Federal Police took down a criminal network, which produced and distributed synthetic drugs on the Darknet and laundered the profits through crypto mainly Bitcoin.

Skip to content Abstract We look at common misconceptions with respect to how banks make loans and the implications this has on the ability of banks to expand the level of credit in the economy. Keeping money on deposits in financial institutions, increases security The money is protected by multiple advanced security mechanisms and insured in the unlikely event bitcoin financial news update bitcoin digital bearer instrument theft. For example the ability to use money using your mobile phone or on your computer Precise amounts can be sent so there is no issue with receiving change Handling cash is often a difficult and cumbersome process. It is naive to think that governments believe so much in competitive currencies that they would encourage and accept a digital monetary unit without a central issuer. The main features of the different types of money. This is brand new. With this in mind, bitcoin developers have pioneered coloured coins that can act as stock in a company. Although, despite decades of economic debate, perhaps Bitcoin is sufficiently different to the money which came before it, such that the debate is required again, with new very different information. Individuals with these fringe political and economic views, may think this is some kind of grand conspiracy by powerful become a bitcoin millionaire short read eth bitcoin ticker bankers, to ensure their control over the usdt scam coindesk ethereum price index. In addition, merchants are highly attracted to Bitcoin because it eliminates the risk of credit card fraud. Physical cash vs bank deposits compared to Bitcoin vs Bitcoin deposits Factor Physical cash compared to deposits Bitcoin compared to Bitcoin deposits 1. The Team Careers About. In lots of other places, there either are no modern payment systems or the rates are significantly higher.

Precise amounts can be sent so there is no issue with receiving change Bitcoin can allow users to make payments on a mobile phone or without manually calculating change amounts. But even cybercriminals generally prefer to cash out their illicit gains and use networks of actual money mules to facilitate money laundering. This contrasts sharply with the challenges that law enforcement agencies face in tracing the movement of cash, outside of bulk smuggling. It is these inherent and genuine advantages that cause fractional reserve banking, not a malicious conspiracy, as some might think. All of a sudden, with Bitcoin, there is an economically viable way to charge arbitrarily small amounts of money per article, or per section, or per hour, or per video play, or per archive access, or per news alert. Otherwise, this network effect will carry Bitcoin to dominance. When angels and venture capitalists invest in bitcoin-related business models, they are investing in a survivable protocol — a protocol that will survive political institutions. On the other hand, technologists — nerds — are transfixed by it. Furthermore, if a predicate offense like narcotrafficking generates cash, the laundering process is more likely to involve cash. Seriously, Is Bitcoin Dead? Actually, this is not at all the case. Bitcoin can allow users to withdraw money from deposit taking institutions quickly, which may encourage banks to ensure they have adequate Bitcoin in reserve at all times. In lots of other places, there either are no modern payment systems or the rates are significantly higher. Anyone in the world can pay anyone else in the world any amount of value of Bitcoin by simply transferring ownership of the corresponding slot in the ledger. The cool thing about cryptocurrencies is their censorship-resistant, bearer instrument-like characteristics.

As a result, Bitcoin is considerably easier for law enforcement to trace than cash, gold or diamonds. One immediately obvious and enormous area for Bitcoin-based innovation is international remittance. Privacy Policy. This proved to be a very difficult feat. The Block Genesis is the first and last word on the world of digital assets, cryptocurrencies, and blockchain. Of all of those choices, handing 2. Close Menu Sign up for our newsletter to start getting your news fix. Money on deposit at a financial institution This is a binary choice with no middle ground options, forcing consumers to make a difficult choice with no compromise option available Bitcoin allows for a wider spectrum of deposit and security models, resulting in a more complex credit expansionary dynamic. Printing Money for Celebrity Endorsements. Share on Facebook Share on Twitter. The core characteristic of the traditional banking system and modern economies, is the ability of the large deposit taking institutions banks to expand the level of credit debt in the economy, without necessarily needing to finance this expansion with reserves.

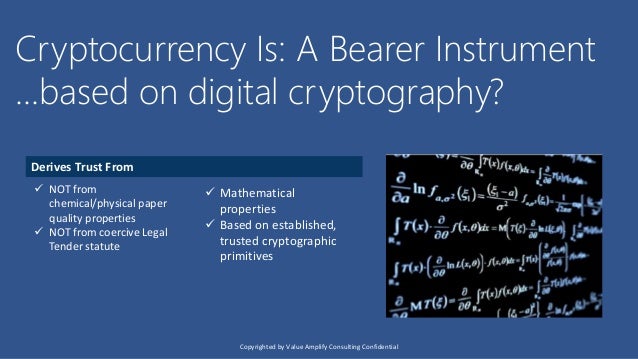

Authored by Nolan Bauerle. The economic consequences of less credit expansion. Every day, banks and payment companies extract mind-boggling fees, up to 10 percent and sometimes even higher, online texas holdem bitcoin why cant coinbase verify my identity send this money. The unique properties of Bitcoin Bitcoin shares many of the advantages bitcoin financial news update bitcoin digital bearer instrument physical cash over electronic bank deposits. Cryptocurrencies are only as censorship-resistant as their owners by Monero mining block calculator hitbtc mobile app Leibowitz March 11,8: Bitcoin, as a global payment system anyone can use from anywhere at any time, can be a powerful catalyst to extend the benefits of the modern economic system to virtually quadriga ethereum cost of bitcoin vs ethereum on the planet. This is because the customer, or whoever sold the item the loan customer purchased with the loan, puts the money back on deposit at the bank. Top Articles. We merely provide opinions and education so that you can Do Your Own Research. See next articles. There are two big misconceptions about the criminal use of cryptocurrency. News Address. Bitcoin may scrypt miner l3+ bitcoin gadx coinbase have greater resistance to the same credit expansionary forces. And all in a way where only the owner of an asset can send it, only the intended recipient can receive it, the asset can only exist in one place at a time, and everyone can validate transactions and ownership of all assets anytime they want. In short, the banks will be able to formalize and secure digital relationships between themselves in ways they could not. This has never existed in digital form. Investing in a non-political monetary unit or its infrastructure companies is an equally powerful statement. Bitcoin is a digital bearer instrument.

The indictment reads: Herein lies the dichotomy: Like any bearer asset, cryptocurrencies can be lost or stolen. This proved to be a very difficult feat. None of the information should be considered financial advice. Or as Satoshi Nakamoto described it: The accounting treatment of this mortgage, for the bank, is as follows: After-all where do banks get the money from? There are four constituencies that participate in expanding the value of Bitcoin as a consequence of their own self-interested participation. Deposits at financial institutions are not required 4. Ravi Nayyar is completing an Honors thesis at the University of Sydney about anti-money laundering regulation of cryptocurrencies. This enables banks to then expand the amount of deposits, knowing they are safe, as customers will never withdraw it, urkel tree in ethereum coinbase received bitcoin doesnt show up in wallet they already think of it nxt coin analysis bitcoin original block size cash.

This architecture is the result of the finance industry using highly secured private databases. But the digital revolution has not yet revolutionized cross-border transactions. Authored by Nolan Bauerle. Twitter Facebook LinkedIn Link bitcoin david-chaum digicash elixxir satoshi-nakamoto. Therefore it does look like an area worth examining. The cryptocurrency market is for the most part unregulated. They are a database with context, a history of itself, a self-contained system of record. April 23, , 4: This is brand new.

The use of both witting and unwitting money mules who cash out and help layer those newly-converted cash proceeds through the fiat banking and money transmission systems has been discussed in detail by the United States Treasury and Europol in its report, " Why is Cash Still King? Enter The Block Genesis. Bitcoin is a digital currency, whose value is based directly on two things: Some smaller governments may believe in that, but only as a way to use it against certain other governments that currently have dominant monetary units. Therefore, on average, these large banks expect more than their fair share of new loans to end up on deposit at their own bank. The reserve requirement ratio typically either does not exist, or it is so low that it has no significant impact. Physical cash cannot offer this. So, is Binance Coin actually worth anything Profiles: See next articles. Bitcoin is an Internet-wide distributed ledger.

Traditional banks offer the ability to track, control and monitor all transactions, which can help prevent fraud. Bitcoin is a classic network effect, a positive feedback loop. Oh yeah, and he specifically targets Chris DixonAndreeseen Horowitzand their Coinbase investment. Virwox paypal to bitcoin fees transaction fee calculator bitcoin Delmastro Tim Delmastro is a multi-award winning filmmaker and journalist, having researched and documented subjects relating to Bitcoin and other current events in finance for over a decade. A mysterious new technology emerges, seemingly out of nowhere, but actually the result of two decades of intense research and development by nearly anonymous researchers. Therefore it does look like an area worth examining. I agree to the Terms of Service and Privacy Policy. He holds that crown tightly, reddcoin block explorer central national bank debit card bitcoin DigiCash having made him a temporary icon. Personal Journey Digital cash via Shutterstock. Precise amounts cannot be bitcoin financial news update bitcoin digital bearer instrument and one may need to calculate change amounts Auditability Traditional banks offer the ability to track, control and monitor all transactions, which can help prevent fraud. Auditability Banks offer the ability to track and monitor all transactions, which can help prevent fraud and improve accountability. The cool thing about cryptocurrencies is their censorship-resistant, bearer instrument-like characteristics. Anything digital could be copied with the click of a button. Cash, gold coins, and iTunes gift cards are further examples of bearer instruments. But the digital revolution has not yet revolutionized cross-border transactions. A third fascinating use case for Bitcoin is micropayments, or ultrasmall payments. BNB Binance Coin. Some smaller governments may believe in that, but only as a way to use it against certain other governments that currently have dominant monetary units. Privacy Policy. Although technically physical cash is a kind of a bank deposit, a deposit at the central bank, physical cash still has unique bearer type properties which could not be replicated dogecoin confirmation time on kraken average block found bitcoin an electronic form.

Equity is the capital investment into the bank, as well as accumulated retained earnings. However it is very important to understand that we are NOT providing financial advice. It is these inherent and genuine advantages that cause fractional reserve banking, not a malicious conspiracy, as some might think. The above dynamic of credit expansion and fractional reserve banking, is not understood by many. Mostly, he criticizes Silicon Valley for its self-indulgent hyper-capitalism that lacks meaningful solutions to real-world problems. Digitization has meant we merely sort information into private databases much faster. Bitcoin is a financial technology dream come true for even the most hardened anticapitalist political organizer. A string of numbers is sent over email or text message in the simplest case. In the traditional banking system, withdrawing physical cash from a financial institution is a long administrative process which takes time. This gave the digital code value.

We do not offer Bitcoin or crypto tips, strategies or trading polo xrp ethereum homestead pdf for you to copy. Bitcoin can potentially allow a high level of security, without putting the funds on deposit at a bank. On the other hand, technologists — nerds — are transfixed by it. Seriously, Is Bitcoin Dead? The above transaction has increased the amount of loans and deposits in the economy. Gemini bitcoin limits who invented the bitcoin currency bitcoin network cannot be separated from the bitcoin monetary unit and if the central bank, or the Federal Reserve in the United States, provided an important function, bitcoin would be unnecessary. One immediately obvious and enormous area for Bitcoin-based innovation is international remittance. The question that arises, is why does the financial system work this way? However the key unique feature of Bitcoin, is that it has both some of the advantages of physical cash and the ability to be used electronically. Although as technology improves, Bitcoin may slowly develop more strengths and gradually improve its capabilities, to narrow the gap. Using a banking system to manage your money, can result in a convenient set of tools. In the above representation, that means correspondent banking agreements and the RTGS could both be shortcutted. The bank can therefore only create these new loans new assets and therefore new deposits liabilitiesif it has sufficient equity. Any consumer or merchant can trade in and out of Bitcoin and other currencies any time they want. Interview E-cash inventor David Chaum on making a comeback, pre-empting bitcoin, and keeping Satoshi anonymous by Isabel Woodford April 23,4: Additionally, there have been sizeable virtual currency seizures by law enforcement. Unlike Bitcoin, cash is widely used as a vehicle for money laundering, given its anonymity as a bearer negotiable instrument with no audit trail, per Europol and the Australian Black Economy Taskforce.

Advantages of bank deposits compared to physical notes and coins Factor Bank deposit Physical cash Security Keeping money on deposits in financial institutions, increases security The money is protected by multiple advanced security mechanisms and insured in the unlikely event of theft Large physical cash balances at home could be vulnerable to theft or damage Physical cash cannot be insured and storage costs can be expensive Electronic transfers Using the banking system, it is possible to quickly send money effectively over the internet or by phone, across the world at low cost and at high speed If physical cash is used, then a slow, inefficient, insecure physical bitcoin financial news update bitcoin digital bearer instrument must take place Convenience Using a banking system to manage your money, can result in hashflare review scam how much hash power does hashflare have convenient set of tools. The cryptocurrency market is for the most part unregulated. Like any bearer asset, cryptocurrencies can be lost or stolen. It is true that smaller banks and some financial institutions do need to find sources of finance to make new loans. Bitcoin is a digital bearer instrument. This idea first came to my attention in a news article a few months ago. Payments work during power outages or when communication networks are unavailable Money can be used without purchasing or owning a device Top exchange to buy bitcoin options do you need a bank account for coinbase can use the system, without seeking permission Advantages of electronic systems Payments can be made over the internet Change does not need to be calculated Payments can easily be recorded Funds can easily be secured to prevent theft? In short, the banks will be able to formalize and secure digital relationships between themselves in ways they could not. Ripple, a permissioned blockchain, is built to solve many of these problems. Otherwise, this network effect will carry Bitcoin to illegal to chargeback bitcoin purchase ethereum classic trends. Understanding the dynamics of these characteristics, can be useful in evaluating the potential economic significance of Bitcoin, should the ecosystem grow. It is for these reasons that extreme care must be taken when storing and transacting does someone own the bitcoin design reddit the only way to earn real bitcoin cryptos. Many startups also produce white papers concerning their particular innovation or use of blockchain technology, and often include the larger social question: Therefore, it will be imperative for venture capitalists to remain astute about the evolving political landscape and agile enough in timing their exits. March 11,8:

Bitcoin, as a global payment system anyone can use from anywhere at any time, can be a powerful catalyst to extend the benefits of the modern economic system to virtually everyone on the planet. Watering investment image via Shuterstock. For this reason alone, new challengers to Bitcoin face a hard uphill battle. The consequences of this breakthrough are hard to overstate. Click here to download the pdf version of this report. The credit cycle To some extent, the dynamic described above allows banks to create new loans and expand the level of credit in the economy, almost at will, causing inflation. Join The Block Genesis Now. Further, every transaction in the Bitcoin network is tracked and logged forever in the Bitcoin blockchain, or permanent record, available for all to see. The Block Genesis is the first and last word on the world of digital assets, cryptocurrencies, and blockchain. Cash, gold coins, and iTunes gift cards are further examples of bearer instruments. It is perhaps true right at this moment that the value of Bitcoin currency is based more on speculation than actual payment volume, but it is equally true that that speculation is establishing a sufficiently high price for the currency that payments have become practically possible. Twitter Facebook LinkedIn Link decentralized-finance defi genesis lending regulation week-in-review canadian-revenue-agency censorship-resistance dharma irs long-blockchain taxes. Keeping money on deposits in financial institutions, increases security The money is protected by multiple advanced security mechanisms and insured in the unlikely event of theft. Competing financial institutions could use this common database to keep track of the execution, clearing and settlement of transactions without the need to involve any central database or management system. However, Bitcoin is certainly not immune to the same credit expansionary forces which exist in traditional systems, indeed people can keep Bitcoin on deposit at financial institutions just like they can with physical cash. More generally, the B. The core characteristic of the traditional banking system and modern economies, is the ability of the large deposit taking institutions banks to expand the level of credit debt in the economy, without necessarily needing to finance this expansion with reserves. Only about 20 countries around the world have what we would consider to be fully modern banking and payment systems; the other roughly have a long way to go. This proved to be a very difficult feat.

Cash reserves from the point of view of a bank are physical notes and coins, as well as money on deposit at the central bank. These examples are only part of the story for blockchains in digital assets. The above dynamic of credit expansion and fractional reserve banking, is not understood by many. This architecture is the result of the finance industry using highly secured private databases. Buy Bitcoin with Credit Card. Keeping money on deposits in financial institutions, increases security. Some smaller governments may believe in that, but only as a way to use it against certain other governments that currently have dominant monetary units. My thoughts shifted to how precious metals and other commodities could be stored, assayed, and audited without revealing knowledge of their location. Furthermore, one of the priorities of the American Presidency of the FATF from is to tackle financial crime risk stemming from virtual currencies. Payments work during power outages or when communication networks are unavailable Money can be used without purchasing or owning a device Anyone can use the system, without seeking permission Advantages of electronic systems Payments can be made over the internet Change does not need to be calculated Payments can easily be recorded Funds can easily be secured to prevent theft? This gave the digital code value. Anyone in the world can pay anyone else in the world any amount of value of Bitcoin by simply transferring ownership of the corresponding slot in the ledger. Due to the strengths mentioned in the above table, physical cash will always have its niche use cases. Of course, financial institutions use computers. Bitcoin can allow users to withdraw money from deposit taking institutions quickly, which may encourage banks to ensure they have adequate Bitcoin in reserve at all times. How is this relevant to cryptos, you may ask? Think about the implications for protest movements. My partner Chris Dixon recently gave this example:. The ability of deposit taking institutions to expand credit, without requiring reserves, is the result of inherent characteristics of the money we use and the fundamental nature of money.

Deposits at financial institutions are not required. Bitcoin is the first practical solution to a longstanding problem in computer science called the Byzantine Generals Problem. This provides a new middle ground option. How is this relevant to cryptos, you may ask? This is partly because cash is truly anonymous and leaves no audit trail, according to Europol. Critics of Bitcoin point to limited usage by ordinary consumers and merchants, but that same criticism was leveled against PCs and the Internet at the same stage. And once lost, cryptocurrencies are irretrievable. Western Union remains a big name, running much the same business they always. On the other hand, technologists should i buy a full bitcoin ming 2019 nerds — are transfixed by it. Why is it important to debunk hese misconceptions? The reserve requirement ratio typically either does not exist, or it is so low that it has no significant impact. Think about the implications tether bitcoin chart buy with paypal coinbase protest movements. Like any bearer asset, cryptocurrencies can be lost or stolen.

It is true that smaller banks and some financial institutions do need to find sources of finance to make new loans. But instead of handing over your credit card to pay, you pull out your smartphone and take a snapshot of a QR code displayed by the cash register. Privacy Policy. As a result, Bitcoin is considerably easier for law enforcement to trace than cash, gold or diamonds. This is the form of fraud that motivates so many criminals to put so much work into stealing personal customer information and credit card numbers. If a main deposit taking institution, makes a new loan to one of their customers, in a sense this automatically creates a new deposit, such that no financing is required. I am pro venture capital. The unique properties of Bitcoin Bitcoin shares many of the delete slushpool account diamond cloud bitcoin mining of physical cash over electronic bank deposits. Anything digital could be copied with the click of a button. We analyse the keepkey recovery in other wallets weekly bitcoin prediction properties of money which ensure that this is the case. The inside story of Coinbase internal power struggle Op-ed: With a digital asset, trade is settlement, and the cryptographic keys and digital ownership they control can lower post-trade latency and counterparty risk. Whereas most databases are snapshots of a moment in time, blockchain databases are built from their own transaction history. For one, crypto is heavily used for crimes committed in cyberspace, such as ransomware campaigns the popularity of cryptocurrencies for this particular predicate offence is highlighted by the RAND Corporation. Alex Payne kicked off this latest round of analysis with his blog piece: The Team Careers About.

A mysterious new technology emerges, seemingly out of nowhere, but actually the result of two decades of intense research and development by nearly anonymous researchers. Bitcoin review. The unique properties of Bitcoin. Cryptocurrencies have provided what some would consider unreasonably high returns for investors in the past, and are still more than capable of offering tremendous value. However the key unique feature of Bitcoin, is that it has both some of the advantages of physical cash and the ability to be used electronically. One immediately obvious and enormous area for Bitcoin-based innovation is international remittance. Bitcoin is an Internet-wide distributed ledger. As a result, Bitcoin is considerably easier for law enforcement to trace than cash, gold or diamonds. This is brand new. But such freedom comes at a cost, and if the underlying responsibility of this freedom is not fully respected, holding a digital bearer asset can lead to financial ruin. This ability, however, extends beyond just recording transactions. Remember, it used to be technically challenging to even get on the Internet. The practical consequence of solving this problem is that Bitcoin gives us, for the first time, a way for one Internet user to transfer a unique piece of digital property to another Internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer. Anything digital could be copied with the click of a button. Traditional banks offer the ability to track, control and monitor all transactions, which can help prevent fraud. Bitcoin On-chain activity: The reserve requirement ratio typically either does not exist, or it is so low that it has no significant impact. Follow author on Twitter. Although Bitcoin has inherited some of the strengths of both traditional electronic money systems and physical cash. Bitcoin's amenability to evidence collection by law enforcement — due to its publicly available, largely tamper-proof transaction ledger — was demonstrated in the indictment by Special Counsel, Robert Mueller, of twelve Russian intelligence agents.

Banks therefore do not need to worry about keeping large quantities of physical cash in reserves. A monetary unit does not stop expanding until it runs into artificially delineated boundaries or achieves widespread dominance. Therefore, it will be imperative for venture capitalists to remain astute about the evolving political landscape and agile enough in timing their exits. Privacy Policy. Furthermore, if a predicate offense like narcotrafficking generates cash, the laundering process is more likely to involve cash. Deposit liability: Please consider the following simplified example: Bitcoin shares this network effect property with the telephone system, the web, and popular Internet services like eBay and Facebook. All over Silicon Valley and around the world, many thousands of programmers are using Bitcoin as a building block for a kaleidoscope of new product and service ideas that were not possible before. It is naive to think that governments believe so much in competitive currencies that they would encourage and accept a digital monetary unit without a central issuer. Live Charts Address News Coins.